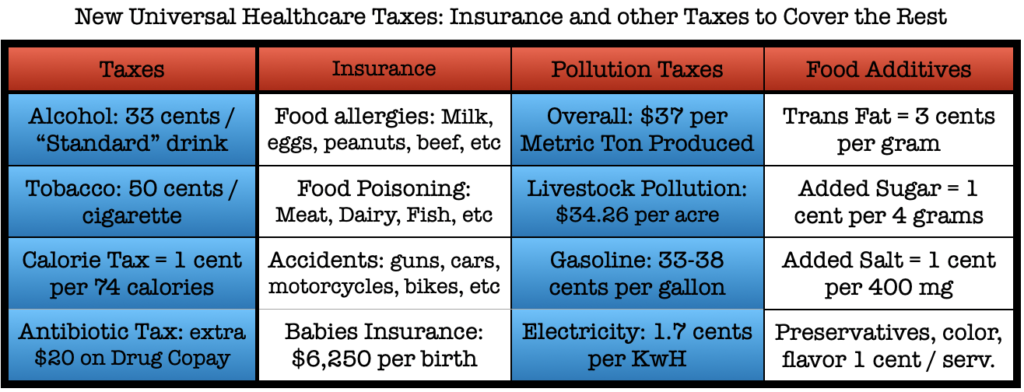

Every choice we make incurs some risk. Some of us, however, take more risks than others. Since people wish to retain their right to live how they choose, regardless of the obvious extra Health costs involved, the only fair thing to do is to charge a tax or insurance cost on specific behaviors that carry this “negative externality” or risk, in order to cover it when it invariably leads to a Health expense. Insurance spreads out these costs among the whole subset of people who choose a particular activity. Taxes really do the same thing, but are attached to activities that any of us might do on occasion. Below is the breakdown.

Table of contents

Alcohol

Alcohol Tax = $40.45 Billion (3.3% of total needed)

- Direct Health Costs = $39.9 Billion in health and accident costs (motor vehicle crashes, boats, bikes, recreational vehicles, etc)

- Proposal: $0.33 per “Standard Drink” [Alcohol By Volume (ABV) X number of ounces = 60]

- [example: beer = 5% ABV X 12 ounces = 60]

- [other examples: Wine = 12% X 5 oz., Whiskey = 40% X 1.5 oz.]

NOTE: There are already taxes on alcohol, plus pricey liquor licenses, etc., and the money does not appear to go to solving alcohol / drug abuse [example: in Oregon, $18.2 million of the $465.2 Million collected from liquor licenses goes to Mental Health, Alcoholism, and Drug Services – only 3.9%. It feels like government is profiting from Alcoholism, not curbing it]. Our only goal is to pay for all the Health Care costs alcohol causes, and are ok to lift any other taxes and only have our federal tax imposed. [see tax rates for alcohol]

* Consumption rate: Americans consume approximately 122,566,080,000 drinks per year

Tobacco

Tobacco Tax = $180 Billion (15% of total needed)

- Direct Health Costs = $180 billion for direct medical care for adults

- Secondhand Smoke = $1.72 B (question to pro-life advocates: do you have the right to kill your born child?)

Proposal: go all in and charge $0.50 a cigarette, or $12.50 for a pack of 25

Again, Our tax is to cover Health Care costs necessary because Our citizens smoke. Other taxes need to be assessed to determine whether they curb smoking, or simply profit from it.

*Consumption rates: 360 billion cigarettes smoked (14.4 Billon packs); 37.8 million U.S. adults currently smoke cigarettes

NOTES:

- A Pack of 25 cigarettes usually costs $5.51 in much of the U.S., as much as $12 in Canada, and in California the average price for a pack of cigarettes hit $7.89 after a recent tax increase.

- Fire deaths from smokers – Cigarette fires cause close to 1,000 deaths and 3,000 injuries each year in the U.S., according to the National Fire Protection Association (NFPA). As the ignition source in fires responsible for over 20% of all fire deaths, cigarettes are the nation’s largest single cause of such deaths.

- Fire Pollution from smokers – wildfires fill the air with very dangerous small particles known as PM2.5, which can get into the lungs and bloodstream. These particles degrade health and contribute to thousands of deaths each year in the U.S. alone by causing respiratory, cardiovascular and other health problems.

Food Additives and Caloric Intake

Food Additive / Calorie Tax = $70+ Billion (5.8% of total needed)

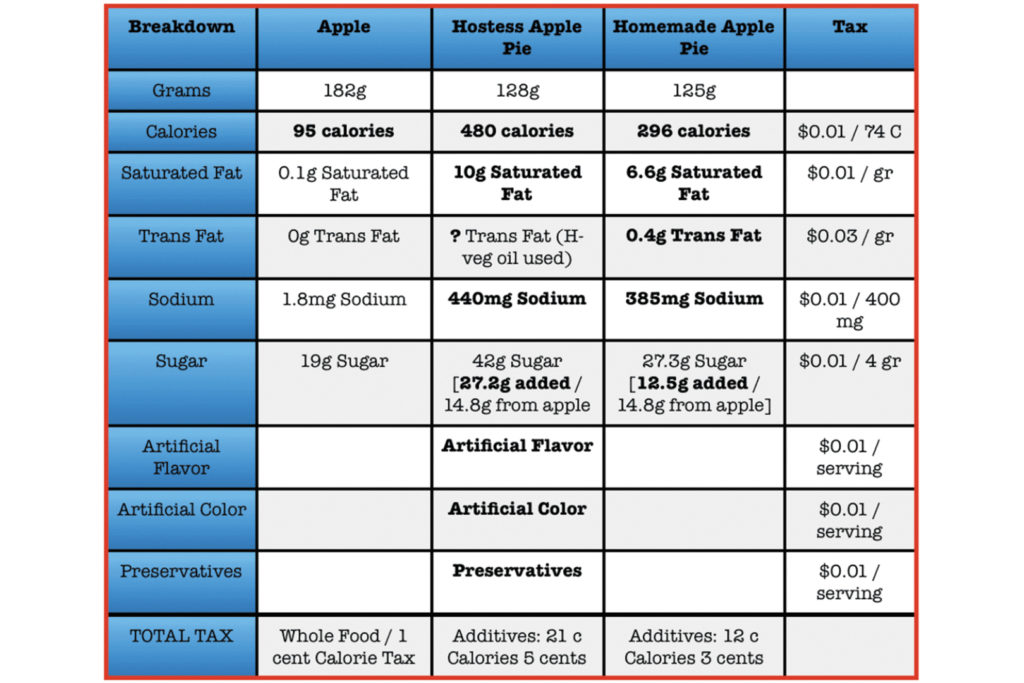

The Current thinking is that sugar, sodium, trans fat, and saturated fat, when eaten in excess, is unhealthy. Most agree that eating whole foods is better than food enhanced with chemicals or “additives”. But the most obvious takeaway is that eating in moderation is the most important thing. Over-eating may be the most obvious predictor of health outcomes from food consumption. Therefore, the proceeding taxes will focus on 1) unhealthy “additives” and 2) on the number of calories being consumed daily.

Food Additives Taxation

‘Whole Foods’ will incur no tax in this category. The hope is that the “maker” of the food (Process Plant, Restaurant, Home Chef) will choose more wisely what is added to their products.

Additives:

- Saturated Fats – 1 cent per gram in the product

- Sodium – 1 cent for every 400mg in the product

- Sugar – 1 cent for every 4 grams in the product

- Trans Fat – 3 cents for every gram in the product

- Artificial Sugar – multiply mgs by sweetness (200-20,000 X) = “sugar” in grams, then 1 cent for every 4 grams, just like natural sugars

- Artificial Flavors – 1 cent per every serving if artificial flavors are present in the product [secret recipes don’t allow public knowledge – companies must pay for this privilege]

- NOTE: these chemicals are added to fool us into eating more of it

- “Natural Flavors” – 1 cent per every serving if “natural flavors” is listed on the product [name the flavor in the ingredients and we cannot charge you]

- Artificial Colors – 1 cent per every serving if artificial coloring is present in the product [there are organic / natural colors available – use them instead and avoid the tax]

- NOTE: these are also used to entice you into eating more

- Preservatives – 1 cent if a chemical / artificial preservative is present in the product, specifically BHT / BHA [we don’t want food poisoning, but there are safe options and if processors “cut corners” there will be a “health” price to pay]

STRATEGY: If consumers stay within the parameters of the “2000 calorie per day diet”, they will only pay $100 a year total in this tax. Also, remember that the Saturated Fat and Sodium in beef or the sugar in an apple cannot be taxed, only if these things are “added” to the food you are eating.

2000 Calorie a day Diet Parameters

- Sat Fat allowance – 13 g @ 1 cent / g = 13 cents

- Sugar allowance – 36 g @1 cent / 4 g = 9 cents

- Sodium Tax – 1500 mg @ 1 cent / 400mg = 4 cents

- TOTAL = 26 cents*

*[$100 a year tax = 27.4 cents a day]

Calorie Tax

Proposal: – 1 cent per 74 calories consumed equals 27 cents per 2000 calorie day = $100 per year contribution to our Health Care System.

* Divide the total calories for whatever food you are purchasing by the number 74 to get the tax in cents.

NOTE: pre-packaged processed food already has the calories and additives listed, but now everything must bear important nutritional information. We will change the legislation to include all restaurants, which must list at least calories per dish on the menu, but a general breakdown of additives like fats, sugars, and sodium (and anything artificial) is discretionary, as they would already have paid the tax when they purchased these raw ingredients.

Bottom Line: Eat crappy food and eat a lot of it, you will likely owe more than $200 a year extra on your overall food bill. Diabetes and heart disease are not cheap. If you eat poorly for many years straight, at least we will have the money needed to care for you.

NOTE: An apple is a whole food. If you make a homemade apple pie, you will only pay a tax for the added sugar and salt and butter. The restaurant’s apple pie will incur the same tax when they buy the raw ingredients, then charge you more in order to get their money back. And when you purchase a “processed” Hostess Apple Pie, undoubtedly the extra cost from the taxed additives will be passed onto you, though ultimately, it is the 480 calories from the Hostess Pie that will directly affect you.

Here is an example of how a typical whole food might be taxed.

Sad news for the apple: While 4 out of 10 apples go to processing, even our healthy store-bought apple will probably go up in price. THIABENDAZOLE (TBZ), an agri-chemical fungicide / insecticide, is used to control various types of rot and mold on apples, while DAMINOZIDE (Alar) increases fruit firmness, color and encourages early maturation in apples. These will likely be taxed, though their function allows apples to remain edible for many months after actually being picked from the tree.

An Example of Hard to Patrol Areas [in order to properly assess Health Tax]:

Eating at a Restaurant with a Soda Dispenser: No one can keep track of your calorie intake if you get several refills, but:

- The Restaurant owner becomes the consumer when he buys Coca-Cola Bag-In Box Syrup [5 gallons]. This will yield 320 12oz drinks.

- [Math: 39g (140 cal) X 320 = 12,480g / 4g = $31.20 sugar tax + 44,800 cal = additional $6.05 calorie tax

BOTTOM LINE: Restaurant owner will pay a $37.25 tax for the Syrup. Possibly this may kill owner’s incentive to allow unlimited soda refills to customers.

Food Poisoning

Food Poisoning Insurance = $14.53 Billion (1.2% of total needed)

There are 15 main food borne illnesses, with big scary names. They cause $14.5 Billion in medical costs. As for how you come to get them:

- 46% of illnesses are from Produce (causes 23% of deaths [$7.1 billion]) 135.4 billion pounds of veggies, 37.8 billion pounds of fruit, 482 million pounds of nuts = 173.68 Billion pounds of produce means 4.1 cents per pound tax

- 22% of illnesses are from meat and poultry (causes 29% of deaths [$3.4 billion]) = 94.1 billion pounds of meat means 3.6 cents per pound tax

- 20% of illnesses are from Dairy and Eggs (causes15% of deaths [$3.1 billion]) Cost will be split as follows:

- 2 cents per egg (caged) = 68.55 billion eggs = $1.37 Billion

- 1 cent per egg (cage free) = 6.45 billion eggs = $64.5 Million

- 4 cents per gallon of pasteurized milk = $800 Million

- 8 cents per gallon of raw milk = $372 Million

- 4 cents per pound of pasteurized cheese = $400 Million

- 8 cents per pound of raw cheese = $80 Million

- 6.1% of illnesses from fish / shellfish (causes 6.4% of deaths [$941.3 million]) 15.5 pounds per person – 4.96 billion pounds per year if use NOAA data = 4.96 Billion pounds of fish / shellfish means 18.9 cents per pound tax

Food-Borne Illnesses

- Yersinia Enterocolitica = $270.14 million in health costs

- Vibrio = $141.5 Million in health costs

- Vibrio Vulnificus = $319.6 Million in health costs

- Vibrio Parahaemolyticus = $39.7 Million in health costs

- Toxoplasma Gondii = $3.295 Billion (meat, cats, water / soil contaminant)

- Shigella (all species) = $135 Million in health costs

- Salmonella (non-typhoidal) = $3.638 Billion in health costs

- Norovirus = $2.165 Billion in health costs (veggies, fruits, nuts)

- Listeria Monocytogenes = $2.832 Billion in health costs (meat / dairy – also, manure can contaminate veggies)

- Escherichia Coli – $20.2 Million (17% of raw milk outbreaks)

- Escherichia Coli O157 = $266 Million in health costs

- Cyclospora Cayetanensis = $2 Million in health costs

- Cryptosporidium Parvum = $50.1 Million in health costs

- Clostridium Perfringens = $342.653 Million in health costs

- Campylobacter (all species) = $1.914 Billion (81% of raw milk outbreaks)

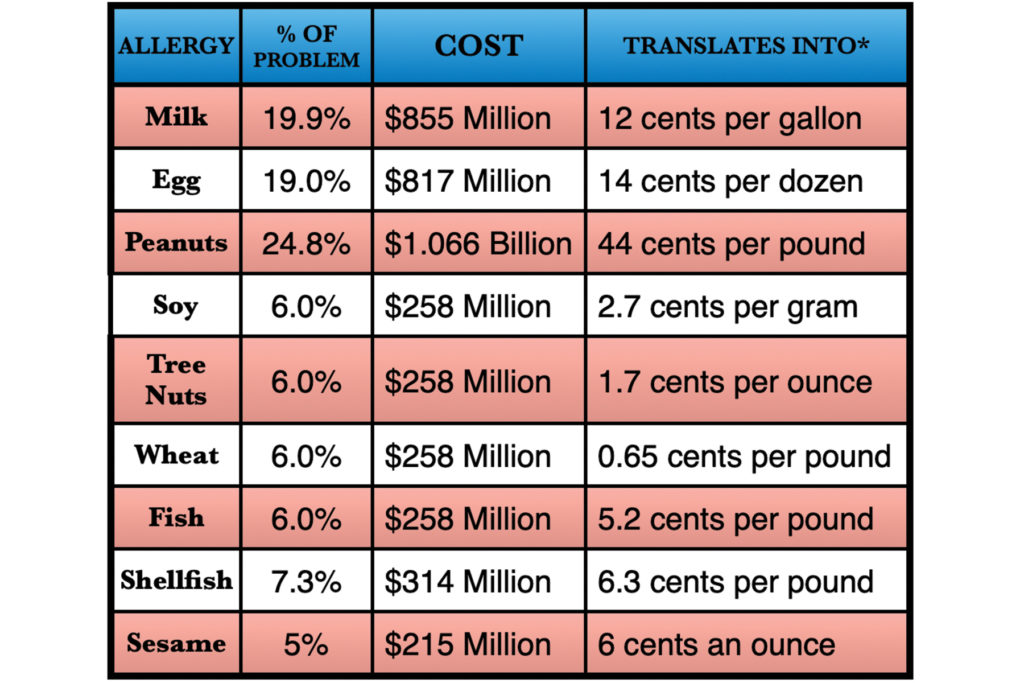

Food Allergy Insurance = $4.3 Billion (0.35% of total needed)

Children have food allergies, some very serious. These are the usual suspects:

*These may or may not be accurate – calculated by dividing amount of direct health cost by total US consumption of the product

STRATEGY: yes, we will need to tax, but consumption and ensuing reaction fluctuate, so whatever numbers are assigned will likely need to be adjusted from year to year.

More on Food Allergies

- Researchers estimate that up to 15 million Americans have food allergies, including 5.9 million children under age 18. About 30 percent of children with food allergies are allergic to more than one food.

- The Centers for Disease Control & Prevention reports that the prevalence of food allergy in children increased by 50 percent between 1997 and 2011.

- Between 1997 and 2008, the prevalence of peanut or tree nut allergy appears to have more than tripled in U.S. children.

- Every three minutes, a food allergy reaction sends someone to the emergency room. Each year in the U.S., 200,000 people require emergency medical care for allergic reactions to food.

- About 40 percent of children with food allergies have experienced a severe allergic reaction such as anaphylaxis.

- Total Health Cost = $4.3 Billion

Beef Allergy Insurance = $3.2 Billion (0.26% of total needed)

- One percent of our population is allergic to galactose-α-1,3-galactose, or alpha-Gal, a type of complex sugar in red meat

- Direct health cost = $3.2 Billion or 12.1 cents per pound on beef [26.4 billion pounds beef consumed per year]

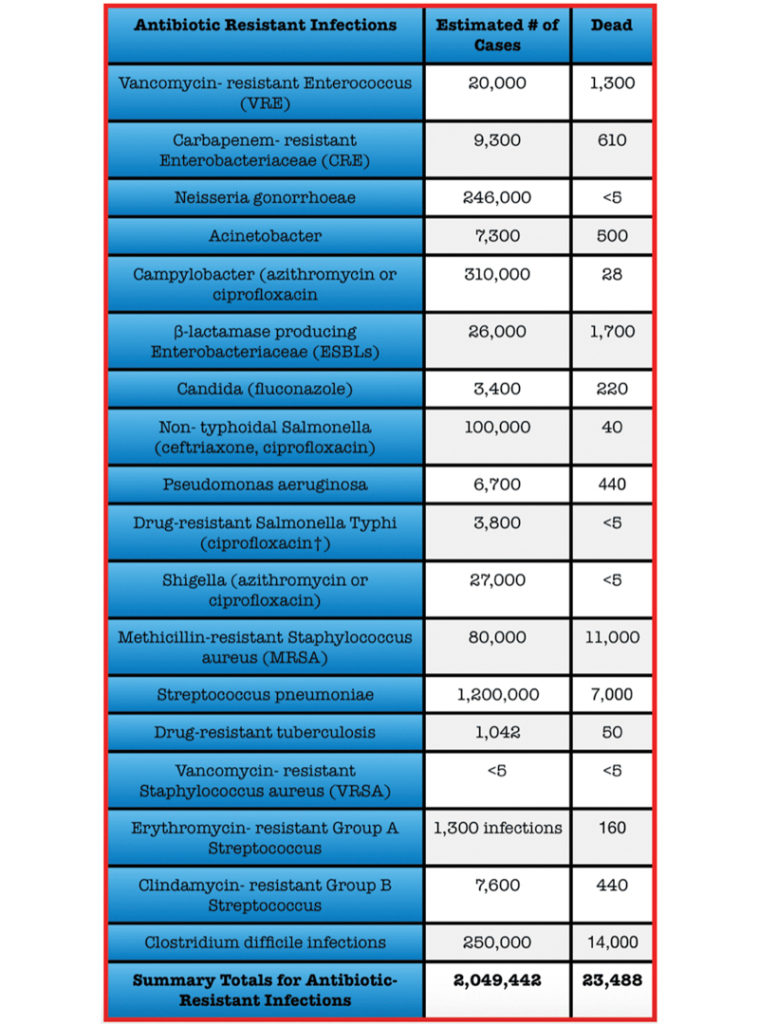

Antibiotic Tax

“Using antibiotics, including misuse and over-use, in healthcare and food production accelerate the development of antibiotic resistance.”—World Health Organization, from the

U.S. NATIONAL STRATEGY FOR COMBATING ANTIBIOTIC RESISTANT BACTERIA

TAKEAWAY: using antibiotics helps bacteria become resistant to them, forcing us to come up with new antibiotics.

Antibiotic Taxation (Humans and Livestock) = $25 Billion (2% of total needed)

- Each year, at least 2 million Americans acquire serious infections with bacteria that are resistant to one or more of the antibiotics designed to treat those infections.

- At least 23,000 people die each year as a direct result of these antibiotic-resistant infections. Many more die from other conditions that were complicated by an antibiotic-resistant infection.

- In addition, almost 250,000 people each year require hospital care for Clostridium difficile (C. difficile) infections.

- In most of these infections, the use of antibiotics was a major contributing factor leading to the illness. At least 14,000 people die each year in the United States from C. difficile infections. Many of these infections could have been prevented.

- In most cases, antibiotic-resistant infections require prolonged and/or costlier treatments, extend hospital stays, necessitate additional doctor visits and healthcare use, and result in greater disability and death compared with infections that are easily treatable with antibiotics. Estimates vary but have ranged as high as $20 billion in excess direct healthcare costs.

Our Strategy

- Eat less meat (taxing the meat should lower purchase of it)

- Put a cap on the amount of antibiotics given to animals (50 milligram of antimicrobials per year per kilogram of animal product is one proposal – at the moment there is no cap on antibiotic use]

- No antibiotics can be given to any human or animal without a prescription

- use of subtherapeutic doses in animal feed and water to promote growth and improve feed efficiency will be outlawed and strictly enforced, with financial penalties imposed.

- legally given when animal is ill (therapeutic), but overuse occurs when antibiotics are given to entire group when one illness is detected (metaphylaxis), or when given purely as preventative treatment (prophylaxis)

- If antibiotics are used on an individual animal, the animal must be separated from the group, and no longer can be sold as “organic”, so will incur the Antibiotic Usage Tax – The meat processing plant and the farm are both responsible (and accountable) in this process, and will be more closely monitored by the FDA and Food Safety and Inspection Service (FSIS), now within the Justice Department.

To discourage overuse, all antibiotics must be prescribed, and a tax imposed on it. As dosage amounts depend on the size of the animal, the tax should be a uniform “Prescription Tax” reflecting the number of prescriptions given and not the dosage or amount. Only 60% of antibiotics given to animals are also used by humans, so for now only those will be taxed (until it is determined that all antibiotics cause health issues)

Healthcare providers prescribe 269.4 million antibiotic prescriptions to all of us in a given year —equivalent to 838 antibiotic prescriptions per 1000 persons – the Federal Hospital System will attempt to cut this number way down (“Up to 50% of all the antibiotics prescribed for people are not needed or are not optimally effective as prescribed,” the CDC says.)

THE COST: $20 Billion is needed to cover all the health costs, plus $5 billion to pay for the crucial research and development of new antibiotics conducted by the FDA, as well as the inspection / enforcement of our current drug use by FSIS.

BREAKDOWN:

- Humans will be charged an extra $20 on their prescription “copay” of $10 for use of an antibiotic (for a total of $30 on any antibiotic prescription) 269.4 million prescription per year X $20 = $5.4 Billion

- An “Antibiotic Usage Tax” will be imposed on any meat where antibiotics were administered, meat will be clearly marked and taxed at 16 cents a pound [amount is based on 94 billion pounds of meat consumed per year, and the $15 Billion we need to pay for the problem]. The hope is that people will purchase only the “antibiotic free” meat (Maximum collected = $15 Billion)

- Finally, we will charge a “Prescription Tax” for animals as well, up to $20 a prescription [there are prescriptions for Tetracycline online that are between $219 and $770 per dose; an extra $20 is not ridiculous].

Accidents

Accident Insurance =approximately $40 Billion (3.3% of total needed)

What a dilemma. We want people to be active, but apparently most of us like to have a potentially life-threatening element attached to our exercise. We already have added coverage for children, but we will have to collect some money from adults to cover this persistent child-like belief that we are invincible.

- Registration Fee on boats, bikes, off road vehicles, Jet Skis, snowmobiles

- Added Fee on Skiing / snowboarding lift tickets

- Fee added to scuba and sky diving certification

- Take off / Landing fee for private planes / rented planes

- Small Fee added to all rented micro-mobility transportation (scooters, bikes, razors, skateboards, rollerblades)

- Small Fees attached to rented water equipment (paddle boarding, rafting, snorkeling, water skis, motorboats)

- Fee added when hang gliding, hiking (in National Parks at least)

- Fee attached to amateur go Kart / drag racing, open and closed wheel racetracks

- Professional sports must have their own special insurance

- No apparent answer to some things like surfing, skateboarding, cliff diving

- Small fees attached to gyms, combative sport facilities, pilates, yoga, etc

For the amazing number of accidents and deaths caused from these activities, look below.

Three national accident-producing pastimes deserve special attention:

- Cars (Direct Health Costs = $23.4 Billion [fatal and non-fatal]) With approximately 222 million licensed drivers, to cover this Health Cost we will put $105.41 per year on everyone’s yearly registration fee. Learn more below.

- Motorcycles (Direct Health Costs = $2.88 Billion [fatal and non-fatal]) With approximately 8.41 million owners, to cover this Health Cost we will put $342.45 per year on everyone’s yearly registration fee. Learn more below. Bottom Line: Motorcycles will never be safe. They cannot be made driverless. Even having their own road won’t keep them safe.

- Guns (Direct Health Costs = $8.6 Billion per year) Estimates are that Americans own 265 million guns (some say 357 million). To collect the $8.6 Billion in direct Health Costs, we would first need to register all guns, then charge a Gun Insurance fee of $32.45 a year per gun. This can be lowered year to year if Health Costs for this particular issue go down. Because guns exist, we also spend $221 Billion on police, disability pay, prisons, legal fees, and lost wages for victims, to name just a few, but we are not going to charge gun owners for all these indirect costs associated with the existence of guns, we just want to cover the health costs.

- This is definitely a contentious issue, and there will be plenty of discussion about it along the way, but we can all agree that guns carry a Health Cost, and only people who own a gun have the potential to incur this Health Cost on the rest of us. We register cars and motorcycles, not to take them away from people, but to be able to collect some of the costs for owning them. We do admit, if you start running people over with your car, or start shooting people with your gun, We will probably take your car or your gun away from you, so maybe don’t do that. Otherwise, We are kind of tired of talking about it. So here’s the deal. If you haven’t already, you will demonstrate your knowledge of firearm safety and secure a Firearm Safety Certificate (FSC).

- You can then purchase and register all of your guns, and pay the $25 a year fee per gun.

- We will also put a tax on all ammunition, until we get to the magic number [$8.6 billion] we need.

- By the way, you cannot purchase ammunition without a current registration.

- If you plan on having an unregistered gun, you better hide it really good, because if you are caught with an unregistered gun, that would be a crime, and the penalty would be to confiscate all of your guns, and you will not be allowed to own guns anymore.

- Finally, we will follow our paradigm of attacking the problem from all sides. Our Military will need a few extra bucks, and weapons are their specialty, so it is only fitting that Military Research and Development will be tasked with making some really cool weapons for the rest of us, that will attempt to cover every legal motive why people would want to possess a weapon, while reducing as many of the illegal “externalities” as possible.

- One example is a “Smart gun”. They aren’t worth stealing (and lots of guns get stolen) because only the registered owner[s] can fire them. This will also make it harder for accidents to happen. People with these guns won’t have to pay the Gun Insurance, just as people with Our [eventual] new autonomous vehicles can avoid the steep Car Insurance fees.

Proposal: $25 per gun per year = $6.6 billion, 10 cents a round of ammo = $1.2 Billion

New guns purchased each year – 23-27 million

54.3 million owners – 7.6 million own half the guns

12 billion rounds of ammo purchased each year

Other Accidents

Junior Sports

- High School Sports – 2 million injuries and 500,000 doctor visits and 30,000 hospitalizations each year.

- Pre-High School Sports – 3.5 million kids under age 14 receive medical treatment for sports injuries each year.

- Takeaway: Junior Sports is a $26 Billion problem

NOTE: 15 million adults still participate in sports. Here is a BREAKDOWN of all 71 million + sports enthusiasts in one year:

- Fitness/Exercise/Health Club: 18,012 head injuries alone ($82.85 Million) 34.5 million participants

- Football: 46,948 head injuries alone ($216 Million) dispersed among 5.5 million player

- Baseball / Softball: 38,394 head injuries alone ($176.6 Million) dispersed among 15.64 million players

- Basketball: 34,692 head injuries alone ($159.6 Million) dispersed among 26 million players

- Soccer: 24,184 head injuries alone ($111.25 Million) dispersed among 24 million (4.2 organized)

- Gymnastics/Dance/Cheerleading: 10,223 head injuries alone ($47.02 Million)

- Golf: 10,035 head injuries alone ($46.2 Million) played by 24 million Americans who play 465 million rounds annually at the nation’s 15,200 facilities = 10 cents per round

- golf cart injuries are 15,000 per year or $1 rental fee or $1 a year on a permit or registration [one study says 40,000 golfers injured a year or $184 Million or 40 cents per round]

- Other Ball Sports and Balls, Unspecified: 6,883 head injuries

- Trampolines: 5,919 head injuries

- Rugby/Lacrosse: 5,794 head injuries

- Ice Skating: 4,608 head injuries

- Roller and Inline Skating: 3,320 head injuries

- Hockey: 8,145 head injuries – men is 1.47 concussions per 1,000 player hours. women’s hockey is higher at 2.34 concussions per 1,000 player hours

- Others: Volleyball (15.3 million participants), Swimming, Water Polo, Roller Hockey

Proposal:

- When possible, a $1 charge attached to rental fees, facilities fees, individuals in games or leagues

Recreational Off-Road Vehicles – Accidents involving all-terrain vehicles (ATVs) – [2005 stats] estimated 136,700 injuries associated with ATVs treated in US hospital emergency rooms, another 767 people died. Direct Costs: between $787.5 Million – $1 Billion ($7500 average medical cost X between 105,000 and 137,467 incidents) Consumers: Estimated 36 million off road vehicles

Proposal:

- Register all ATV’s, off-road go karts, sandrails, dirt bikes, dune buggies, etc. – for 36 million vehicles, cost would be $28.64 per year registration – imagine some might not register, if caught without a sticker, there will be a fine, but if injured without registration, medical costs should come out of retirement dividend.

Go Karts – supposedly 80,000 participate in karting, while more than 10,000 go-cart injuries to children 15 and younger occur each year. We hope these stats are wrong! Also appears that the “track insurance” does not really cover you when you do get injured. Yikes!

Initially: Make Karting illegal unless you are at least 12 years old and weigh more than 80 pounds. Otherwise, we will need to collect nearly $940 per year for each participant, which is ridiculous. Also, we will need to enforce adult supervision and many other safety regulations at the various tracks. This might be a job for our Federal Lawyers. Meanwhile: Single rides can be as much as $20 on indoor tracks.

Proposal:

- We will slap a $2 to $5 fee on each race, and monitor the data closely…

Skateboards/Scooters: 23,114 head injuries alone ($106.3 Million) 64,500 U.S. children and teens were treated in hospital emergency rooms each year — about 176 a day for skateboarding-related injuries. Fractures and dislocations among the most common injuries ($1465 for dislocated shoulder, $10,000+ for setting a broken bone – data implies $343.5 Million spread over 6.44 million skaters = $53.34 per skater per year

Proposal:

- We will need to put a tax on the actual skateboard or rented scooter or razor, also on the skate parks. Meanwhile, people need to register their skateboard as a vehicle if using it on the street, otherwise it can be confiscated. (With New Transportation Grid, we can have a special space for these vehicles)

- Interesting Skateboarding Facts: A professional-quality skateboard retails for more than $250. The average skateboarder in the United States is a white male, 14 years old, and comes from a household with an average income level of $50,000 or more. Skater numbers have gone from over 10 million in 2006 down to 6.4 million in 2016.

Combative Sports – All forms of boxing, Mixed Martial Arts (MMA), all forms of kickboxing, all forms of wrestling, Jiu Jitsu, full contact Karate, Tae Kwon Do, Judo, aikido, Kung Fu, different types of fencing, use of blades or sticks, ai Chi, etc. The rate of injuries, expressed as percentage of participants sustaining an injury that required time off training a year, varied according to style: 59% tae kwon do, 51% aikido, 38% kung fu, 30% karate, and 14% tai chi.

Winter Sports – feels like these sports are hiding their injury stats a little – Mammoth Hospital [Mammoth Ski Resort] – yelp review: “They do their best to be as efficient as possible, even when they’re busy with a lot of skiing and snowboarding accidents.”

Skiing / Snowboarding – 56.4 million skiers + 13.6 million snowboarders a year

Proposal:

- Lift tickets are $75, $95, even as high as $130, so $5 per day on lift tickets is cheap (and more than likely not enough) – but rest assured, health data will be reviewed, and taxes altered annually to ensure payment is adequately covered

Snowmobiles – over 1.2 million registered snowmobiles in the US, 200 deaths and 14,000 injuries per year – should be $115 a year registration fee, but snowmobilers only pay a one-time fee of $50 and away they go.

Proposal:

- need to establish a $20 yearly registration fee, with a $115 fine for no visible registration sticker

Sledding – 23,000 injuries ($230 Million per year)

Proposal:

- Snow Parks have visitor permits / daily rates as high as $27 per adult or $21 for kids. Add $3 a day charge for all ages

Water Sports

There is an estimated 30.2 million participate in water sports – most of them are unsupervised

ANOTHER ISSUE: $2.9 Billion a year in health costs related to recreating in polluted waters

Boating – 4,158 accidents per year – 626 deaths, 2,613 injuries ($40.8 Million) – 14 million boats in US. Also, must add all the risky things people do while attached to the rear end of the boat: Para-sailing, Water Skiing, Water Tubing, Wake Boarding – Also, some carbon monoxide poisoning is related to Boat engines

Proposal:

- Boat carries visible registration yearly registration –$5 charge / yr.

Jet Skiing / Personal Watercraft (PWC) – a subset of recreational boating – 624 injuries, 46 deaths in a year.

Proposal:

- Visible yearly registration required – $5 per year

Scuba Diving certification – yearly renewal requirement

Once any Scuba Diving training is complete, students receive a C-Card or a Certification Card. This card acts like a license to dive, and all dive shops are required to ask to see this card before renting out equipment. 150 dive related deaths per year – 3 million divers.

Proposal:

- can pay a $5 renewal on C-Card every year

Aquatic or Beach Rentals – All equipment that leaves these shops can have a $1 added insurance tax – can cover

- Body Surfing

- Boardsailing/Windsurfing

- Kayaking (White Water, Sea/Touring, Recreational)

- Rafting

- Snorkeling

- Surfing

- Stand-Up Paddling

- Diving

- Cliff Diving

- Plus, Bikes, rollerblades, skateboards…everything

Hiking in National Parks – 160 deaths / 13,500 injuries per year ($280 million)

Proposal:

- $1 added to daily visitor fee for all National Parks (may need to patrol more hiking areas)

Horseback Riding: 14,466 head injuries alone – ($66.5 Million)

9.2 million horses in the U.S. 4.6 million Americans are involved as horse owners, service providers, employees, and volunteers – $7.23 a horse every year (unless there is no way the horse will be ridden at all – adjust the fee if there are less horses actually ridden)

Proposal:

- register horses that are ridden, pay $10 “insurance charge” per horse to cover accidents.

Skydiving – cost of a tandem skydive is $220 – $250 – a USPA license course (25 jumps) costs $2649 – $3000

Proposal:

- $5 a year on a renewable license, $1 on tandem jumps

- In 3.2 million jumps, only 24 people die in a year

- There are 38,000 USPA members = $190,000

Cycling – average $13.94 Billion per year (fatal + non-fatal) for 104 million bike riders =$135 per bike! We have to do better!

Proposal:

- Bike Registration – Need to take a DMV type test, and pay a registration fee – need $135 a bike, so that will be the fine if your bike does not have any visible registration, but actual registration cost will be $40 per year – $20 of it will go to health care or $1.33 Billion, meanwhile the other $20 will go upgrade national bike infrastructure every year until each city has safe lanes dedicated to bikes only

Private Planes – 97% of aviation fatalities occur in general aviation, not in commercial flights – an average of 5 small planes crash each day – 1500 crashes, 387- 500 deaths annually ($296.1 Million) 11,261 private jets (2013) 164,200 general aviation aircraft, 24,142,000 flight hours posted per year – 74% of airports are private, overall, 15,631,000 flights a year commercial and private

Proposal:

- Costs $12.26 in direct crash costs for every flight hour in the sky. Charge $10 on landing fees for private aircraft, see what happens.

Helicopters – crash 35% more than private planes – there are around 35,000 pilots

Proposal:

- Yearly license and registration – $15 a year

Falls:

- Elderly [65+ seniors falling is the highest total]

- $25,500 direct medical cost for fatality (24,190 fatal)

- $9,500 direct medical cost for non-fatality (3.2 million non-fatal)

We need some kind of INVENTION: something to keep elderly safe if they lose their balance

Drowning:

2000 deaths – leading cause of death for ages 1-4 (pools and bathtubs, hot tubs, ice chests, toilets, irrigation ditches – basically anything with water)

We need some kind of INVENTION: something to keep 1-4 yr olds from drowning

Proposal:

- Public Pools will cover a $5 charge, private pools must be covered and / or have access barriers

- Install a four-sided fence with a self-closing, self-latching gate around all pools and spas.

- Designate an adult Water Watcher to supervise children at all times around the water.

- Learn how to swim and teach your child how to swim.

- Learn how to perform CPR on children and adults.

- Teach children to stay away from pool drains, pipes and other openings to avoid entrapments.

- Ensure any pool or spa you use has drain covers that comply with federal safety standards. If you do not know, ask your pool service provider about safer drain covers.

Choking:

2500 deaths (hot dogs)

Fires:

2700 deaths – as many as 500 of them are from someone smoking

Poisoning:

39,000 deaths – Top culprits are opioid pain medications, such as oxycodone, hydrocodone and methadone, with cocaine and heroin ranked second and third.

Proposal:

- when we legalize a drug, we can control its usage more. Meanwhile, we already have a $5 charge on prescription drug copays to cover overdose and other misuses we can control.

Carbon Monoxide Poisoning = $1.32 Billion

Sources of carbon monoxide:

- Gas water heaters

- Kerosene space heaters

- Charcoal grills

- Propane heaters and stoves

- Gasoline and diesel-powered generators

- Cigarette smoke

- Propane-fueled forklifts

- Gasoline powered concrete saws

- Indoor tractor pulls

- Boats engines

- Spray paint, solvents, degreasers, and paint removers

- Smoke inhalation from a wildfire

Risks for exposure to carbon monoxide include

- Children riding in the back of enclosed pickup trucks (high risk)

- Industrial workers at pulp mills, steel foundries, and plants producing formaldehyde or coke (a hard grey fuel)

- Personnel at fire scenes

- Using heating sources or electric generators during power outages

- Those working indoors with combustion engines or combustible gases

- Swimming near or under the stern or swim-step of a boat with the boat engine running

- Back drafting when a boat is operated at a high bow angle

- Mooring next to a boat that is running a generator or engine

- Improper boat ventilation

Pollution

Pollution Tax = $269.45 Billion (includes mercury emissions) (22% of total needed)

Pollution is 100% about Health; the Health of our species, and our planet. We will place the overall Carbon Tax rate at $37 per Metric Ton of Carbon produced [By the way, some experts argue it should be $220-230 per MT, so calm down. This will lead to the following costs to consumers:

Gasoline Tax

Proposal:

- 32.9 cent tax per gallon on gasoline = $40.63 Billion

- 37.6 cents per gallon on diesel = $16.7 Billion

- 35.4 cents per gallon on Jet Fuel = $6.124 Billion

Electricity Pollution Tax

NOTE: the consumer has no control over electric company’s choice of electricity generation, but between coal and oil and natural gas, 1823.08 MMT of Carbon is being produced. We will spread the cost out among everyone.

Proposal:

- 1.7 cents per KwH of electricity used

Special Coal Tax for Mercury Emissions –

NOTE: The mercury released by coal-fired power plant is converted into a far more toxic form when it enters the food chain. We will use the current calculation of 665 million short tons of coal burned / year [1.33 trillion pounds] and the $29 billion in direct Health Costs it produces.

Proposal:

- Mercury Emissions Tax of 2.2 cents per pound on any coal used or purchased

Industrial Pollution Tax

SOURCES: Heat in industrial processes / space heating in buildings, Boiler fuel to generate steam or hot water for process heating and generating electricity, Feedstocks (raw materials) to make products such as plastics and chemicals.

Proposal:

- There are lots of sources of the pollution, but the number is the same: $37 per MT of pollution produced.

Agricultural Pollution Tax

SOURCES:

- 44.4% of the emissions come from the Agriculture Soil [decaying of organic soil releases CO2, methane, and nitrous oxide] or 260.2 million MT = $9.627 Billion. Breakdown:

- 216 million acres of land used for livestock

- 62 million acres used for wheat

- 3 million acres for vegetables

NOTE: Not all ground can grow food. Because soil is not organically rich in nutrients, it needs to be treated in order to sustain crops, resulting in GHG Emissions.

- 57% of GHG Emissions are related to synthetic fertilizer

- 36% is related to use of lime to improve soil quality, make it more alkaline

- 13% related to residue crops laying around viable)]

- 37.8% more comes from the Livestock [but beef requires 28 times more land, 6 times more fertilizer and 11 times more water than producing pork or chicken – this means that “producing beef releases four times more greenhouse gases than a calorie-equivalent amount of pork, and five times as much as an equivalent amount of poultry.” [If chicken is a “1”, then pork = ‘1.25’ and beef = a “5”] Also, within Agri-business, CO2 is released during fertilizer manufacture, and during refrigeration

NOTE: From the EPA – Unless prohibited by other State or local laws, agricultural producers can dispose of solid, non-hazardous agricultural wastes on their own property. This includes:

• manure and crop residues returned to the soil as fertilizers or soil conditioners, and

• solid or dissolved materials in irrigation return flows.

Proposals:

- $34.26 per acre Land Use (Carbon) Tax on Agriculture*

*In theory, planting trees or pasture or fertile grassland actually captures carbon instead of emitting it – every acre of agriculture land that is used in this manner will not be charged

- 20 cents per pound added to beef

- 5 cents per pound added to pork, veal, lamb, and mutton

- 4 cents per pound added to chicken and turkey

- [or 8.7 cents per pound added to all meat]

BOTTOM LINE:

- we all need to eat less meat – by charging the actual price for meat, consumers will be better able to understand the unsustainable nature of it

- we don’t need the soybeans and the corn, plant pastures and trees and even add fertile grasslands and we won’t charge Agri-business owners the land use tax

Commercial Pollution Tax – Simple. 1.7 cents per KwH will suffice.

Residential Pollution Tax (Burning Oil, Wood, etc. for heat)

Proposal:

- Coal tax = 4.8 cents per pound (typical 25 lb. bag = $1.20 tax)

- Heating Oil tax = 37.6 cents per Gallon

- Wood Burning tax = 3.2 cents per pound of wood (a cord of wood could run $126.92 in taxes)

Other proposed Taxes

- Propane Tax

- Kerosene Tax

- Gas Water Heater

- Charcoal Tax

- Boats OR gasoline powering boats

- Spray paint, solvents, degreasers, and paint removers

Proposal:

- Any form of fuel incurs an extra one cent per gallon tax, certain products like paints / solvents / degreasers / paint removers also incur a 2 cent per gallon tax – charcoal is only 0.5 cents per pound

ATTACK BOTH SIDES OF THE PROBLEM

Plains used to hold tall grass, more trees, that created a huge carbon sink – we need to capture / sequester carbon at the same time we are reducing the production of it. “Supply-side approaches, centered on CO2 sources, amount to reshuffling the Titanic deck chairs if we overlook demand-side solutions: where that carbon can and should go,” says Thomas J. Goreau, a biogeochemist and expert on carbon and nitrogen cycles who now serves as president of the Global Coral Reef Alliance. Goreau says we need to seek opportunities to increase soil carbon in all ecosystems — from tropical forests to pasture to wetlands — by replanting degraded areas, increased mulching of biomass instead of burning, large-scale use of biochar, improved pasture management, effective erosion control, and restoration of mangroves, salt marshes, and sea grasses.

All Greenhouse Gas emissions:

- Carbon = 82%

- Methane (CH4) = 10% (cows, natural gas)

- Nitrous Oxide (N2O) = 6%

- Fluorinated Gases = 3%

- IMPORTANT: fires release about 290 million metric tons of carbon dioxide a year

Special Water Pollution Tax on Meat = $2 Billion, but will likely go toward fixing the problem]

FACTS:

- Animals make 100-164 times the waste that humans do, but it is often not regulated

- Freshwater Pollution Costs US At Least $4.3 Billion A Year ($2.9 billion from recreating in polluted water)

- Industrial agriculture is among the leading causes of water pollution in the United States. The Environmental Protection Agency (EPA) determined agricultural activity was identified as a source of pollution for 48% of stream and river water / 41% of lake water.

Proposal:

- Meat causes $2 Billion in water pollution = 2.1 cents per pound tax added to all meat Industry causes the other $2.3 Billion. This may need to be collected through fines.

BOTTOM LINE:

- Meat will not survive the way it is currently produced, with taxes on water and pollution and land value.

- Providing Anaerobic Methane Digesters to farms can capture farm waste, and turn it into electricity, potable water, and more fertilizer for the soil.

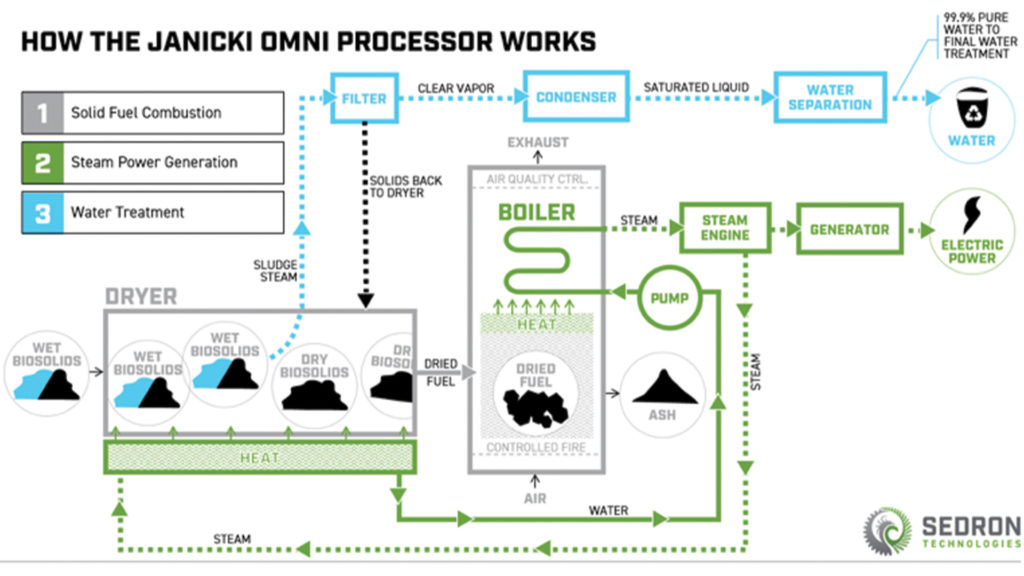

- Money for these “Omni-processors” can come from the water pollution tax, and could help eliminate this tax in the future.

- We like meat. We will undoubtedly try to fix meat for a while longer, we like it so much. One idea:

- Build our own Waste to Energy Plant (Bio-fuel), use the water pollution tax on meat to build it (still charge the 2.1 cents, but build the Energy Plants with that)

- Omniprocessors cost $1.5 million – The next generation of the Omni Processor can handle waste from 100,000 people, produce 86,000 liters of potable water per day and generate a net 250 kw of electricity. (would need 4 of them for one large farm)

Omni-Processor Facts

Called an “Anaerobic Methane Digester”, it captures 18.25 metric tons of CO2 per ton of methane per year. Anaerobic methane digesters work by placing farm waste such as manure into an airtight chamber which then harnesses emitted gasses and converts them to energy that can be used to power nearby appliances, electronics, and even homes. The remains can also be used as excellent sources of fertilizer.

Testimonial

Alberta-based Livestock Water Recycling, whose machinery processes manure into commercial-grade fertilizer and distills the water for irrigation and farm animals. Today, the company has systems (which cost up to $1.5 million to install) in New York, Michigan, Wisconsin and Indiana.

Birth Control

Birth Control = $180 million (0.01% of total needed)

FACTS: There are about 4.4 ischemic strokes for every 100,000 women of childbearing age. Birth control pills increase the risk 1.9 times, to 8.5 strokes per 100,000 women. This is still a small risk; 24,000 women would have to take birth control pills to cause one additional stroke.

Proposal = 45 cent tax on each 3-month dosage

A Los Angeles Planned Parenthood office quoted these prices for having an abortion:

- $648 for a surgical abortion through 11.6 weeks. Later: $800 at 12.1 to 15.6 weeks, $1,050 at 16 to 17.6 weeks, $1,700 at 18 to 19.6 weeks, $2,225 at 20 to 21.6 weeks, $3,275 at 22 to 24 weeks.

- Non-surgical abortion (the pill) costs $605.

FOLLOWING PROCEDURE:

Women [of course] have a Constitutional right to vote, own a gun, or choose whether or not to have a baby, and we have an obligation to protect these rights. When it comes to a woman wishing to terminate a pregnancy, we will first inform her of an option to have her baby, then give it up for adoption. Everything before and at least 6 weeks after birth will be paid for through our Baby Fund (One of the Federal Charities), and if there is consent from all parties (the woman, the charity, and the prospective parents), an equitable arrangement may transpire.

That being said, the choice to have an abortion or to have a baby are personal choices that come with financial costs; costs that the People will not be asked to shoulder. The Planned Parenthood price quotes above are from the current system, so it is very likely We can offer the same thing for even less money. Whatever the choice, payment will be arranged ahead of time.

Baby Insurance

Baby Insurance = $45.12 Billion (3.7% of total needed)

Every choice we make incurs some risk. Now that our fates are all tied together (in this case, with our Health Care), we will choose to pay Premiums in order to cover all the typical Health Costs that might occur along the way. One such Health Cost is being born. So far, every one of us currently living was born at some previous point in time. No argument so far.

But in some of the choices we make, there are extra Health “risks” (negative externalities) specific to that choice. Traditionally, we have used the concept of “insurance” payments to spread the “risk” out among the entire subset of people who choose to partake in a specific activity. As this concept is both effective and already accepted, We will use Insurance to describe any “extra” payment that individuals need to make in order to maintain the freedom to live their lives the way they choose.

Unfortunately, when parents choose to have a baby, there are Health risks specific to that activity that need to be covered. The fair thing to do is to impose an insurance cost, spread out among all babies born.

- The average medical cost for a healthy, full-term baby from birth through the first year is $5,085. For premature and/or low birth weight babies (less than 37 weeks’ gestation and/or less than 2500 grams), the average cost is $55,393. Around 10% of approximately 4 million babies born each year are preterm = 400,000 preterm births X added cost ($55,393 – $5,085) = $20 Billion, or $5,000 for all new mothers each year.

- Birth Defects occur in 3 of every 100 children. Birth defects cost the U.S. healthcare system approximately $23 billion a year, but the true (or direct or initial) cost of Birth Defects is only $5 billion, or $1,250 for all new mothers each year. Here are some of these birth defects:

- Congenital Heart Defects

- Sickle Cell Disease

- Spina Bifida

- Club Foot

- Cleft Lip or Palate

- PKU (phenylketonuria)

- Missing or Undeveloped Limbs

- Down Syndrome

- Fragile X Syndrome

- Tay-Sachs disease

BOTTOM LINE:

- We are paying for the actual birth, vaginal or caesarian. If the birth is successful, we are also paying that average cost of $5,085 for the first year of follow up care. We are also jumping in right away with childcare, pre-kindergarten care, $380,000 more in education, and all the rest.

- It is your right to roll the dice and have your baby outside of the Federal Hospital System. Within our system, however, the cost of having your baby will be $6,250.

In this new system, our fates become tied together. As a society, we need your child to be:

- as healthy as possible

- as self-sustaining as possible

- as educated as possible

- as helpful and giving as possible

- as empathetic and open-minded as possible

We will be there for your child 100%, because we have a vested interest in how it all turns out. In this new era of conscious interconnectedness, there is no excuse for parents to be isolated from all that we will provide.

- Pre-natal care

- First year assistance

- Childcare until age 3, when Pre-K will begin, etc.

STATS

Prenatal care

The percentage of women receiving prenatal care in the first trimester of pregnancy was 73.7 percent among the 36 states and District of Columbia that reported this information in 2011 – only 6 percent of pregnant women received prenatal care late in pregnancy or not at all.

Pregnancy weight gain

- In a 30-state reporting area during 2009 and 2010, 31.8 percent of women gained the recommended amount of weight during their pregnancy, 47.8 percent gained an excessive amount of weight, and 20.5 percent didn’t gain an adequate amount of weight.

- Gestational weight gain recommendations vary based on a woman’s pre-pregnancy weight and height.

- Inadequate weight gain is associated with a higher risk of problems, such as low birth weight and preterm birth, while excessive weight gain is linked to problems including gestational diabetes, preeclampsia, c-sections, and weight retention after pregnancy.

Moms-to-be who smoke

In the 24 states that kept track of this information in 2011, 1 in 10 women reported smoking during the last three months of pregnancy. Those who did so were more likely to cause major health problems for their babies, including low birth weight, preterm birth, and certain other birth defects.

TAKEWAYS

We need every child to start out equal for as long as possible. We need to be there for the mother and child every step of the way. The mother needs to take advantage of every service We are offering. If the mother cannot stay “clean” prior to her child’s birth, We need to be ready to help. If the mother needs to give the baby up, or take a break from raising the baby to focus on herself, We need to have options in place and ready.

TOTAL OF ALL HEALTH TAXES = $1205.154 Billion