The 10% ‘income investment’ and ‘retirement dividends’ explained.

I. Our 10% Income Tax Investment

The 10% Income Investment is a tax imposed on total revenue in a given year, for individuals, businesses and corporations.

Deductions

There will be three guaranteed deductions for any individual, business, or corporation:

- Money, clearly documented, that is given to another American Citizen (usually as compensation, such as a Salary) who would then be responsible for investing the 10% instead.

- Any Gift is considered giving a ‘salary’ to an ‘employee’, even if it is a family member or friend, therefore the recipient of the gift would receive a 10% income or capital gains tax on it.

- Money collected from businesses for any continued Payroll Tax (businesses cannot deduct amount taken from employee’s portion of this tax, and employee, who will never receive their [5%] contribution, cannot take this deduction either)

- Money given to charities –but only those on an official Federal List of Deductible Charities. People have the right to give their money away, but the government will only reward such giving if it benefits the whole of society, or lessens a cost previously incurred by the taxpayer. The list would likely include:

- Federal Research and Development

i. Health Care Research

ii. Cancer, Alzheimer’s, MS, Parkinson’s… - All things still in development, that will benefit Governments essential needs mandate

i. Energy Research

ii. Transportation Research

iii. Education Research

iv. Military Research

v. Science and Technology Research - People on the Fringes

i. Homeless Aid

ii. Global Aid (through Global Schools)

iii. Immigration Aid (through Immigration Centers)

iv. Rehabilitation Aid (through Rehabilitation Centers)

v. Victims of Violent Crime Aid (through Justice Department)

vi. Veteran and Elderly Retirement Fund - Paying off the National Debt

- Special Causes

i. Natural disasters, unforeseen emergencies, causes suddenly entering National spotlight. - The Baby Fund*

*There are currently an estimated 650,000 abortions performed each year. The cost to bring a child into the world is around $32,000 initially. The mother will likely need 6 weeks minimum pay to recover ($2700 more), for a total of around $35,000. If you wish to sponsor a child, you may give to this Federal Charity, and mothers coming into the Health Care System seeking an abortion would be made aware of this ‘option.’

To avoid loopholes in this ‘investment’, it may be necessary to limit deductions in the above manner. We would likely need to honor Mortgage Interest Deductions made prior to the creation of the National Public Bank, but in the future, it is possible that only deductions from National Bank Loans would be allowed. By sewing up all the usual loopholes, the excess money that people has more of a chance to ‘trickle down’ to those who could use it.

Understanding the New Corporate Taxes (Corporation are people, too, right?)

Corporations get the same Deal as Our “United Citizens”, which is 10% of total Revenue minus:

- SG & A (Salaries – other stuff will be well-defined)

- R & D (but only if the corporation shares its R & D with our government. If it does not want to share, we would not be obliged to make this a tax deduction (FYI: things like computers, the internet, GPS, Solar, Nuclear and so much more were conceived by Our government and pretty much handed over to the private sector, from which they profited greatly, with not a dime of compensation coming back to the rest of Us, who footed the bill for this Research with Our tax money).

How can Businesses and Corporations pay less taxes?

- Pay employees more

- Use our People’s Bank when borrowing any money (This would be subject to a congressional vote)

- Give to Specific Charities of our choosing

- Corporations could decide they no longer want the rights that citizens enjoy (in other words, as long as corporations enjoy all the freedoms / liberties that citizens do, then they should consider themselves part of our Team, and should pick up an oar and row right along with the rest of us)

Other potential deductions that might be considered:

- Businesses could provide a “basic need” to its employees [not only is that a deduction expense, but it will not result in a taxed gain for the employee either.] Examples:

- Gym membership or even the cost associated with building a gym onsite at the business, but employees must be given ample time to use it, and there needs to be monitoring to show usage [Health Value]

- Company Transportation, if it is purchased from a short list of (more than likely American or Federally-owned) Businesses – [transportation is a basic need]

- Food – a cafeteria on the premises perhaps – again, this needs to be monitored (no laundering money through the cafeteria)

- Housing – only if it is “on site” or business-owned housing (careful, any rent taken will be taxed)

Capital Gains

Short and Long Term Realized Capital Gains are now both taxed at 10% regardless of yearly income. To Investors and Day Traders: the laws will now treat you the same as gamblers. All your “winnings” are considered taxable income, and must be listed / itemized, along with all losses. Losses can only be deducted up to the amount of your winnings, and only if losses are clearly itemized. Deductions from losses do not carry past the year in which they occurred.

Example of 10% Income Investment on a Big Business

Let’s look at one of our favorite American Companies, Apple (2016 numbers):

APPLE INCOME STATEMENT HIGHLIGHTS

- SALES / REVENUE = $214.23 B

- COGS (cost of goods sold) = $131.51 B

- GROSS INCOME = $82.72 B

- *SG & A = $14.19 Billion, which include salaries

- R&D = $10.512 Billion

- Interest = $1.46 Billion

- Pretax Income = $61.37 B

- Income Tax = $15.69 Billion

- Net Income = $45.69 B

Effective tax rate is 25.56 % on the pretax income of $61.37 Billion

*SG&A (Sales, General, and Administrative Expenses)

These represent “Overhead costs” to a company. Sales, general, and administrative expenses are usually recurring; they include things like rent, salaries, and money spent on office supplies. They do not generally include one-time costs. They form one of the single largest expenses a company can incur. These expenses are included in one category on financial statements and are subtracted from revenue when calculating operating income.

Apple had to pay $15.69 Billion in the old version of Corporate Taxation. Our version would look like this:

Total Revenue = $214 Billion

Salaries are near $14 Billion

Research and Development (if shared with the Government) is another $10.5 Billion

Bank Interest MAY be counted, and this appears to be $1.46 Billion

We will assume here that Apple does not wish to pay its employees any more money and does not wish to give to any of our Federal Charities.

$214 Billion (Total Revenue) – $14 Billion (SG & A, which is mostly salaries) – $10.5 Billion (shared R & D) – $1.46 Billion (Bank Interest, hopefully Our Bank) = $188 Billion X 10% = $18.8 Billion

Bottom Line: Apple would owe roughly $3.1 Billion more in taxes under The Third Option system.

Note: whatever method companies use to pay their ‘higher ups’ (CEO, CFO, etc.) is fine, but the National Bank would still take 10% of the estimate value of it at the end of each year, otherwise the business would not be able to claim a ‘deduction’ for it.

Year to year, it is hard to know what a business’s profit margin will be. If, at the end of a year, Apple wishes to give “bonuses” to all its employees in relation to how well the company has performed, this would be considered a deductible expense; some uniform dispersal of bonuses is recommended.

Anything made overseas and then imported into the United States will incur our 10% Import Tax (or VAT) –that goes for raw materials, component parts or entire finished products. NOTE TO APPLE: It’s ok to charge us more for iPads, iPhones, iPods, iMacs, etc., We love them.

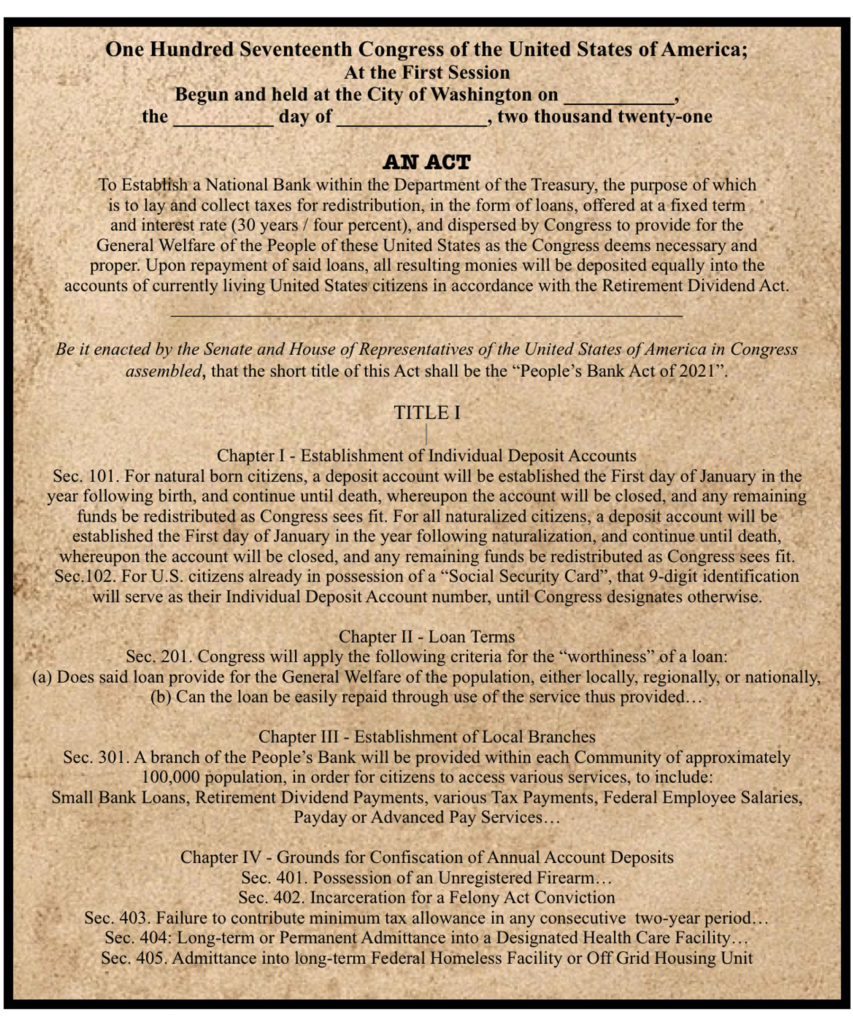

II. Retirement Dividends

Logistics

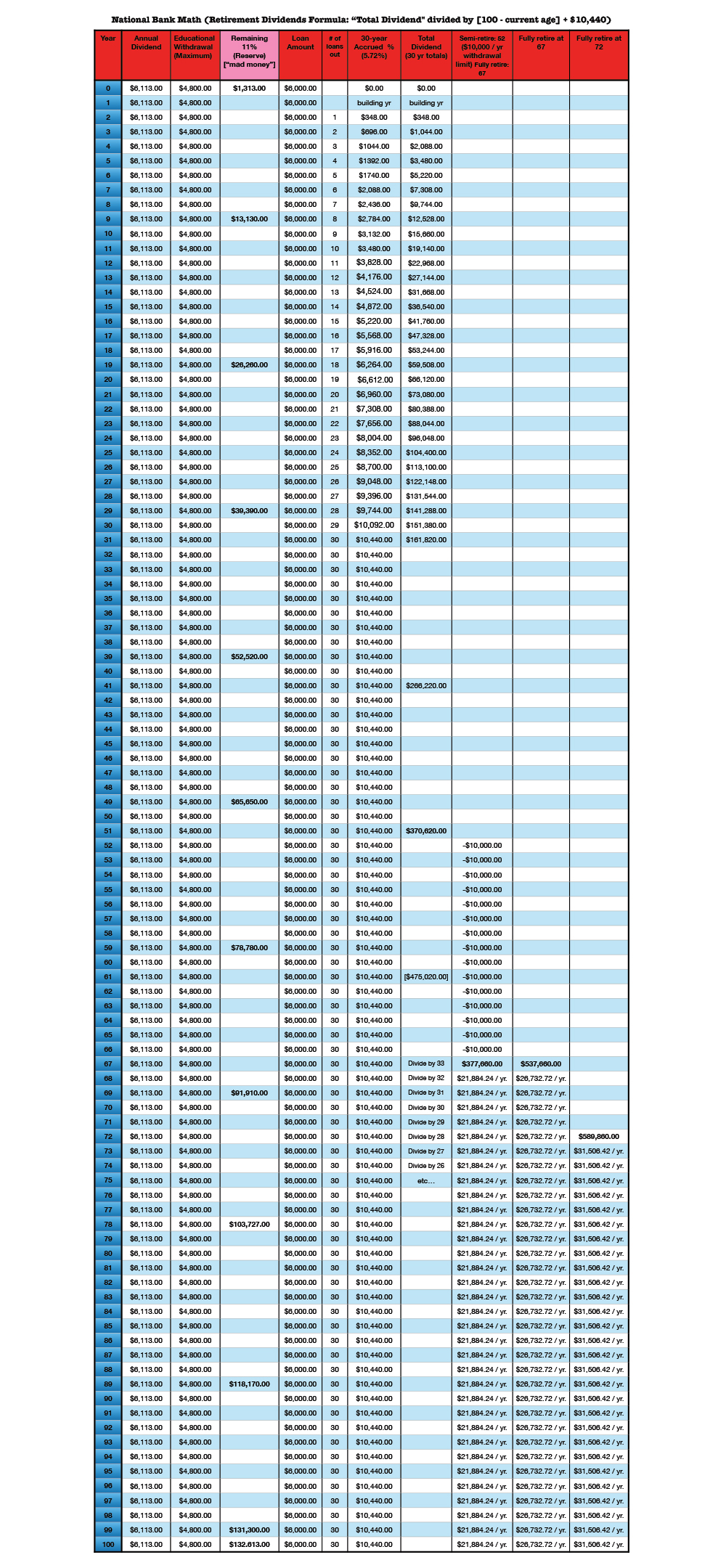

If you worked 30-hour weeks for half the year (26 weeks) while making the new $15 an hour minimum wage, you would yield $11,700 by year’s end, and owe a $1,170 “Income Investment” Tax for that year.

Thus (until someone deems otherwise), $1,170 could be arbitrarily designated as the minimum contribution needed each year in order to receive a Retirement Dividend down the road. Even if you are selling crack on the street for a living, give us $1,170 of your earnings (no questions asked), and if you make it to age 67, you could finally move out of your parents’ basement and retire. If you are over 18, still live at home, and have managed to get your parents to pay for you NOT to work, they would also need to cover this $1,170 on your behalf. Suckers.

Everyone between 18 and 67 would need to contribute. There would be a dip in your Retirement Dividend every year the “System” sees less than $1,170 was contributed. If you are unable to work in any given year—and contact your Bank branch ahead of time—someone could discuss options with you.

All monies collected each year would be deposited in the National Public Bank and divided equally among every US Citizen. Any new accounts (new citizens, newborns, etc.) would be initiated January 1st of the following year (January 1st will also be the day retirees can begin receiving monthly retirement or semi-retirement benefits, if they so choose.)

Loans would be generated from these “deposits” at a flat rate of 4% interest over 30 years. The Mortgage Payments on these loans would be divided equally among all living US citizens and deposited into a second account labeled “Retirement Dividends”.

The original “deposits” would never be directly accessible to individual residents; they could be allocated to A) cover National Education needs, B) pay for individuals who are receiving some form of long-term “Rehabilitation”, C) cover individuals who owe the Bank or the IRS money, or 4) cover the “Reserve Requirement” on all the Loans the National Bank makes.

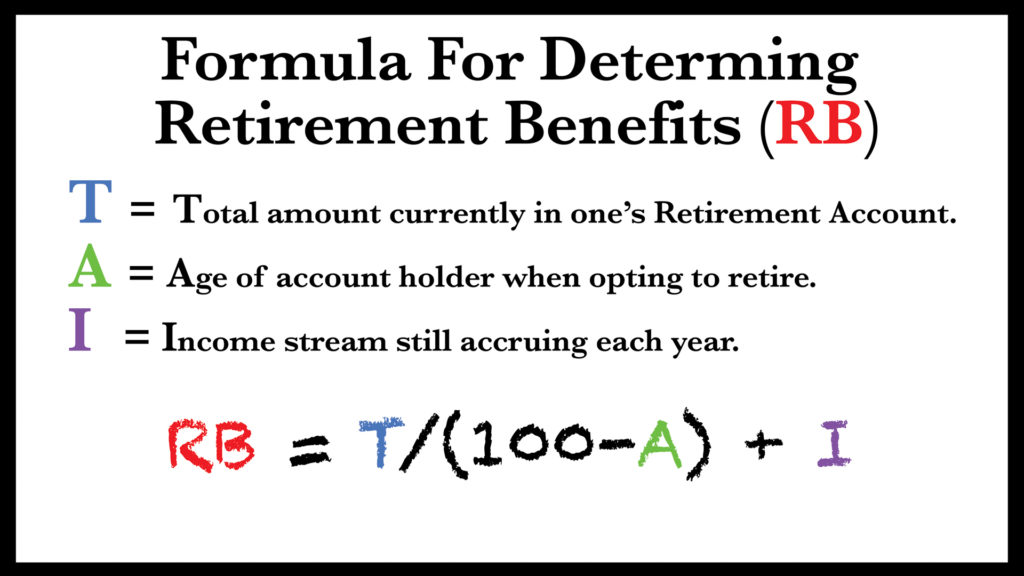

For as long as a US Citizen is alive, interest would accrue on their share of the various loans outstanding. Meanwhile, loans themselves are also accruing, as new money is being loaned out each year. By the time a citizen reaches 31 years of age, the maximum yearly amount entering their Retirement Account should be reached, because 30 years of loans would be outstanding, while all loans issued prior would be paid off and cleared from the books.

This maximum yearly income stream would continue forward throughout one’s lifetime. Once minimum retirement age is reach, one can start receiving full benefits any time. Full Benefits may be calculated this way:

Any ‘principle’ money left over at the time of would be collected and used for various government purposes; Possible uses could be:

- To pay down Our National Debt

- To help pay for our National Health Care System

- To fund Government Research and Development

- To fund National Education

- To pay for National Security (let’s not have to do that, please)

A second strategy might be to only give out the yearly income stream, and not the accrued “principle”, which would make for a big pay day for the Federal Government when you finally pass away. This “principle” could become one’s Personal Health Dividend, if necessary (like Medicare now). Chances are many elderly citizens will already be using the Retirement Dividends to pay their monthly Health Care Premiums anyway.

While no one can withdraw from the ‘principle’ amount until age 67, it would be permissible to begin receiving “interest only” payments starting at 51 years of age, as some may find themselves in need of financial assistance, or simply wish to try “semi-retirement”. This of course will lessen a citizen’s Full Retirement Dividend when finally reaching 67 years of age, but does allow another option for how to get from here to there.

REQUIREMENTS

You must have An Account Number, equivalent to your Social Security Number.

You must register all your weapons. This includes your manually driven vehicle of choice, and anything that shoots bullets. Remember, We must register weapons in order to fairly assess, impose, and collect necessary Health Insurance Taxes.

PENALTIES

All monies owed to the National Bank (through payments into Health Care or other Government Basic Needs) would be subtracted at year’s end, unless other arrangements have been made.

All monies owed to the IRS ($1,170 is the minimum, for example).

Any long-term care would require confiscation of an individual’s yearly “share” or deposit. This would include Admittance into Health Care Facilities like Memory Care or Assisted Care, or admittance into Rehabilitation Programs like a Homeless Village, Off-Grid Housing, or Federal Prison Rehabilitation Program— basically any circumstance where, in effect, a person becomes a “ward” of the United States would necessitate accessing one’s individual National Bank account.