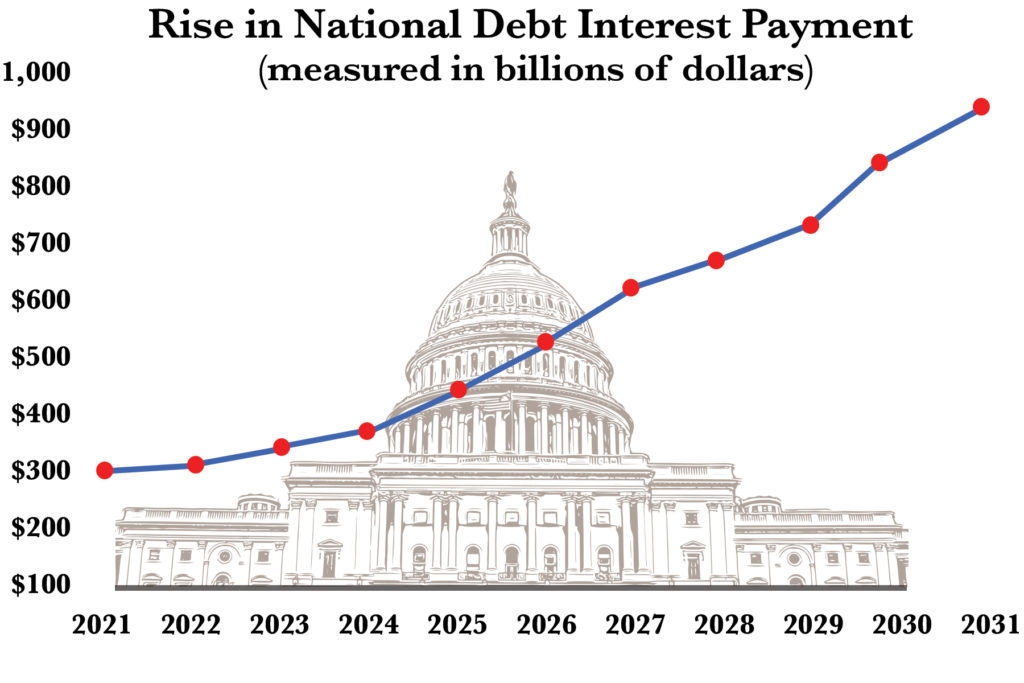

Currently hovering around $350 billion in interest payments alone, the $29 trillion National Debt is expected to grow threefold in the next ten years, as interest rates steadily rise.

About one third of the total federal debt—and nearly half of debt held by the public—is held internationally by either foreign investors or foreign central, who buy our Treasury bonds as investments. These countries include China ($1.3 trillion), Japan ($1.2 trillion) and Brazil ($262 billion), who currently hold the most U.S. debt. Foreign holders of national debt also exist among the oil producing nations (including Iran, Iraq, Kuwait, Ecuador, Nigeria and others, $297 billion) and Caribbean banking centers (Bermuda, Cayman Islands, and others, $293 billion).

The U.S. Federal Reserve Bank and state and local governments also hold substantial shares of federal debt held by the public. The Federal Reserve’s share of the federal debt is not counted as debt held by federal accounts, because the Federal Reserve is considered independent of the federal government. The Federal Reserve buys and sells Treasury bonds as part of its work to control the money supply and set interest rates in the U.S. economy.

THIRD OPTION PLAN:

- Every year the New Retirement Dividend is in existence, the amount of money left in the Bank (from citizens passing away) will get larger and larger. Perhaps 10 years out, we could start using the remainder to pay down the principle on the Debt, once we subtract the amount allocated to pay for Health Care.

- Another source of money will come when we are through paying off the Bank Loans for Housing, Communication, Health Care, Energy, Transportation, etc. Then much of the money we continue to bring in (through user fees) are pure profit, to be used however each new generation of Americans decides is best (extra Retirement Dividends, payment of yearly Federal Government costs, or paying down the National Debt are all possibilities).

- After we have funded all our initial infrastructure projects, we could take a huge chunk of our debt and pay it off through the Bank, turning it into Retirement Dividends. A $2 Trillion dollar Bank Loan means a yearly mortgage payment of $114.58 Billion. For the $363 Billion we are currently paying in National Debt interest, we could chop $6.336 Trillion from our current Debt, and turn it into $10.89 trillion in Retirement Dividends in 30 years, or $33,000 for every U.S. Citizen.

BOTTOM LINE:

Someone must be getting a financial boost from putting the rest of us in debt, but since it is We the People who are paying down the Debt (through taxation), we should be the ones reaping whatever financial benefit can be garnered from it.

In The Third Option plan, The National Debt interest payment costs the American people nearly as much as the rest of the Federal Government Budget combined. The Third Option has a way to eliminate it, through utilizing the National Public Bank to turn the debt into credit (aka Retirement Dividends). If we figure out how to eliminate war as our national pastime, the entire Federal Government could cost about $168 billion. The current Federal budget is $6.11 trillion.

Some Light Reading