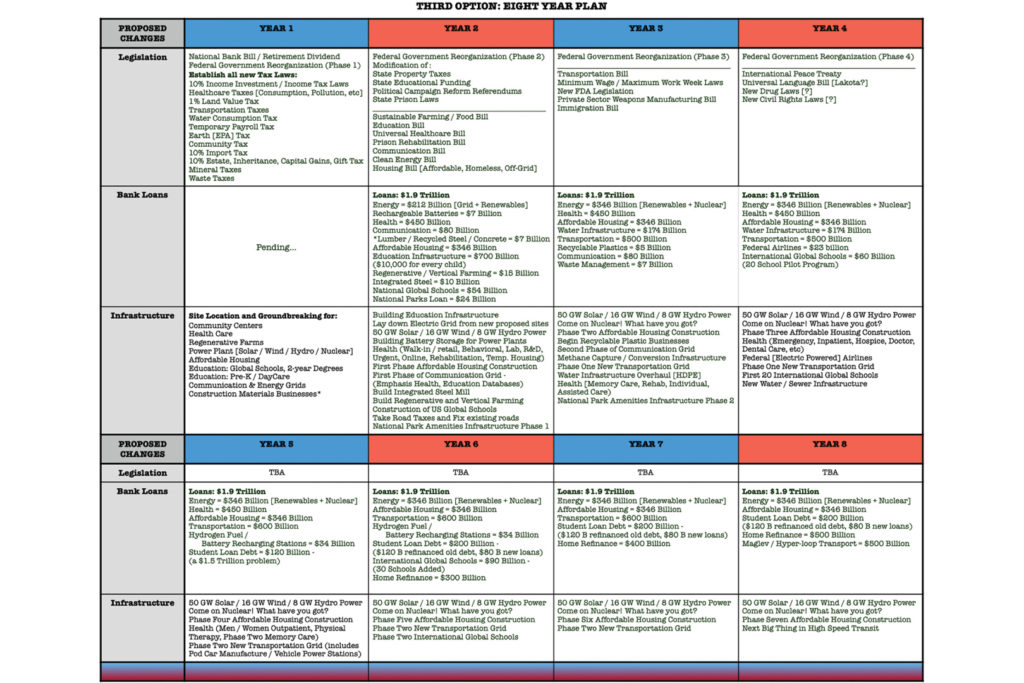

In order to enact change, several legislative bills would need to go through Congress for a vote. Note to Ourselves: We do not want any “riders” on these bills. Riders are extra legislation tacked on from special interests, basically amounting to extortion, where a member of Congress will not vote for Our bill unless they get some totally unrelated and usually controversial legislation to “ride along for free” on Our bill.

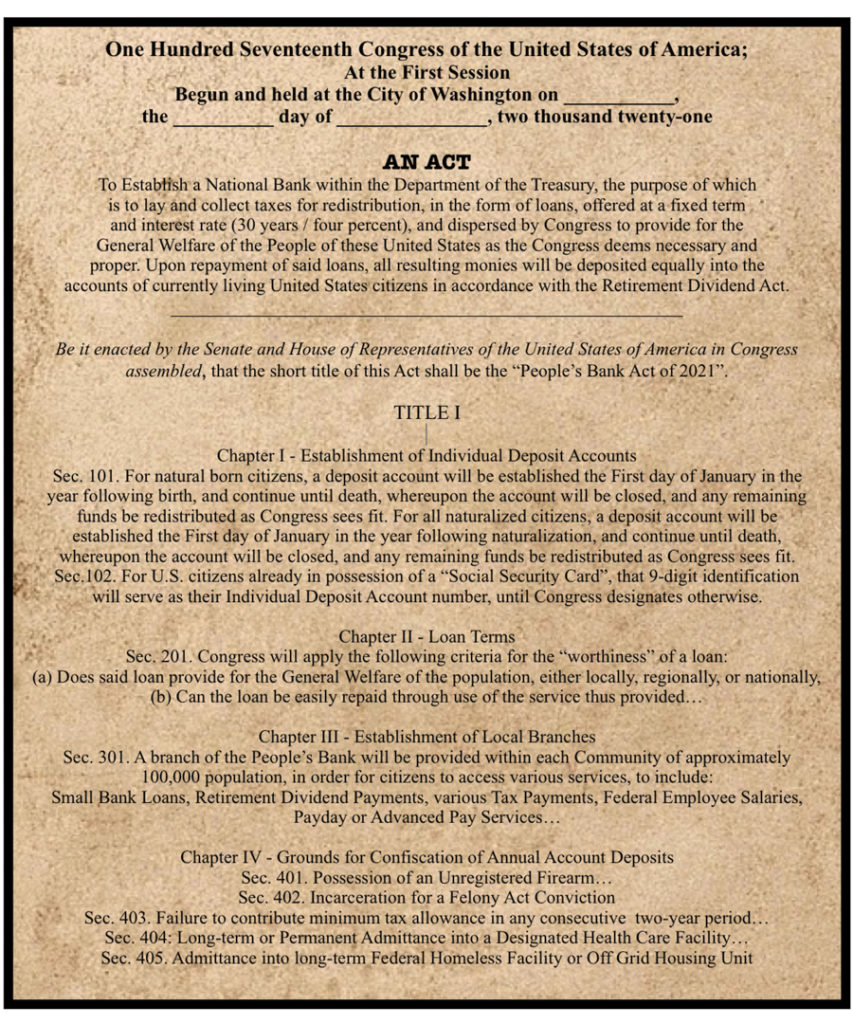

People’s Bank Act

- Bank Capital comes from the collection of the Federal “Income Tax”, the total of which will be equally divided by the current number of US citizens. This amount or “share” will appear as a deposit placed into the Personal Retirement Account of each citizen one year of age or older.

- For natural born citizens, a savings account will be established the first day of January in the year following birth, and continue until death

- For naturalized citizens, an account will be established the First day of January in the year following naturalization, and continue until death

- Upon the death of each citizen, that citizen’s account will be closed, and any remaining funds will be redistributed as Congress sees fit

- U.S. citizens already in possession of a “Social Security Number” can use this as their account number until Congress determines otherwise

- Loans will then be made from all deposited monies. Loans must:

- Provide [in some way] for the General Welfare, either of an individual citizen, or an entire local, regional or national population, and

- be easily repaid (as through use of the service it provides)

- A “branch” of the People’s Bank will be provided within each “Community” of approximately 100,000 population, so citizens may have access to services, such as Small Business Loans, Retirement Dividend distribution, various Tax Payments, Federal Employee Salaries, Payday or Advanced Pay Services, etc.

- Certain actions or inactions by citizens may constitute grounds for confiscation of one’s annual account deposit, such as possession of an unregistered firearm (one or more year fine), incarceration for conviction of a Felony Act (for the entire term of incarceration), long-term or permanent admittance into a designated Health Care Facility (for entire term of stay, failure to contribute the minimum income tax allowance [designated by Congress] in any consecutive two-year period, failure to pay any debt owed to the People’s Bank (health care, affordable housing rent, student loan, etc. – penalty will equal the amount owed.

Retirement Dividend Act

Defining of Terms

- Annual Share – amount allotted to each citizen annually, representing that citizen’s share of the Income Tax collected each year.

- Educational Investment – a yearly amount [to be determined by Congress] which is withdrawn equally from each citizen’s Annual Share, but never from the Retirement Dividend

- Retirement Dividend – the annual amount of accrued principle and interest, divided equally among all citizens, and placed within each citizen’s retirement account, alongside any remaining portion of the accruing Annual Share.

- Full Benefits – Until the formula for determining a citizen’s Full Benefits is changed by an Act of Congress, Full Benefits may be calculated this way: An Amount X, which is equal to the total accrued amount within a citizen’s personal account at the time they opt to receive Full Benefits, divided by Y, which is equal to 100 minus the current age of the beneficiary (67 or older), then added to R, which represents the continuous yearly accrual of Retirement Dividends still coming into every citizen’s account each year. [X / (100 – current age) + R = Full Benefits]

Manner of disbursement of Retirement Dividends

- No monies within each citizen’s retirement account may be utilized by that citizen until the first day in January following their 51st birthday. At this time, and until the first day in January following that citizen’s 67th birthday, withdrawals may not exceed that year’s Retirement Dividend.

- Beginning the first day in January following a citizen’s 67th birthday, a citizen may opt to receive “Full Benefits” at any time.

- Example: Citizen opts for Full Benefits at age 70. At that time, total accrued amount X = $450,000. Retirement Dividends equal to $10,000 a year are still accruing annually. $450,000 / (100-70 yrs) = $15,000 + $10,000 = $25,000 Retirement Benefit per year, or $2,083.33 per month.

- Upon the death of each Citizen, their account will be closed, and any remaining monies will be taken and used as Congress sees fit.

Federal Government Reorganization Act (Phase 1)

- Department of Communication

- Department of Labor and Commerce

- Department of the Treasury

- Department of Healthcare and Human Services

- Department of Housing and Community Development

- Department of Agriculture

- Department of Education

- Department of Security

- Department of Foreign Relations

- Department of Energy

- Department of Justice

- Department of the Interior

- Department of Transportation

Changes to Executive Departments:

- Establishment of a New Department of Communication

- Joining of Department of Labor and Department of Commerce into the Department of Labor and Commerce

- Joining of Department of Homeland Security, Department of Veterans Affairs and the Department of Defense into the Department of Security

Department name changes:

- Department of Health and Human Services to Department of Health Care and Human Services

- Department of Housing and Urban Development to Department of Housing and Community Development

- Department of State to Department of Foreign Relations

Changes within Executive Departments:

- General Changes Within All Departments:

- Complete Elimination of all Inspector’s General Offices

- Across-the-board pay reduction, the amount to be directed by Congress but will not exceed 30% of current salary

- A 4-year phasing out of all Grants, Subsidies, Insurance, and private sector contracts, unless otherwise re-established by some future Act of Congress (Note: all science and technology research and development will be done “in house” as soon as possible )

- An 8-year phasing out of current Federal Government employee benefits, concurrent with the phasing in of Universal Health Care and Retirement Dividend Benefits, plus other potential “affordable” needs benefits to be determined by future Congressional Act.

- Reorganization of Department hierarchical structure where each Department is headed by a much smaller “Executive Team” located in Washington DC, which coordinates policy with Federal “Community” Branches located within Congressional Districts such that offices are established in areas equal to approximately 100,000 citizens per Federal Branch Off

- Specific Changes Within Each Department

- Department of Communication

- Acquiring all government information databases: Centers for Disease Control (CDC), Bureau of Economic Analysis (BEA), Substance Abuse and Mental Health Data (SAMHSA), Housing and Urban Development Data at HUD, Education Research from ERIC, Energy Citations Database (ECD), Government Accountability Office (GAO), Child Welfare Information Gateway, Federal Highway Administration, NFFD, National Telecommunications and Information Administration, Organic Agriculture, Alternative Farming, Pesticide Database from Agriculture Department, plus new Educational and Healthcare databases, Executive to Community level communication databases, and so much more

- Department of Labor and Commerce

- From former Labor Dept. will keep BLS in some capacity, and from former Commerce Dept. will keep BEA, BIS, Patent & Trademark Office, and National Institute of Standards & Technology. Establishment of Federal Businesses: Construction (Steel / Timber / Concrete), Renewable Energy / Electric Company, Water & Waste Management, Affordable Food, Communication, Retail Health, Transportation (Federal Clean Energy Airlines, Pod Car Dealerships, Maglev Rail Services, Driverless (Uber) taxis, Driverless (Uber) Delivery / Sanitation / Moving Vehicles, Clean Heavy Freight Rail System, Hyperloop Transportation)

- Department of the Treasury

- Establishment of Office of People’s Bank, Office of Taxation (Health Care, Income, Land Value, Environmental [EPA, Waste Management / Recycling, Carbon], Community Investment, Natural Resource, all Capital Gains [Estate / Inheritance, Gift, Variable Forward Contracts, Stock Sales], Import, Temporary FICA, Transportation [FAA, Road / Rail / Runway Usage]), Office of Sustainable Innovation (all Research & Development: Health, Education, Transportation, Energy, Military, Science & Technology [NASA], Food Science)

- Department of Healthcare and Human Services

- Also establishes a new Office of Rehabilitation, and Office of the Disenfranchised, to bring mental suffering into the realm of healthcare where it can be better managed

- Department of Housing and Community Development

- Community Branches of Government will be comprised of Construction Teams, utilizing engineers, scientists and other community development experts to best fulfill the infrastructure vision of each Community

- Department of Agriculture

- Gutted completely down to Executive Team and Community Teams

- Department of Security

- New Offices include Homeland Security, Cybersecurity, International Security (former Defense Department), Veterans Affairs, Nuclear Waste Management, FEMA, FBI (which will house DEA and ATFE), FMC, and a Special Forces Branch

- Department of Foreign Relations

- Establishment of International “Community” Branches within new “Global School / Embassies.”

- Department of Education

- At minimum this budget must fund a second Assistant Teacher / Counselor for every classroom, facilitate infrastructure funding, and not only foot the bill for 600 + Global Schools nationally [complete with Administrators and staff], but another 200 schools internationally, also with Administrators and staff funded through this Department.

- Department of Energy

- Establishment of 8 different Offices within Sustainable Energy: Hydro, Solar, Nuclear, Wind, Energy Grid, Transportation, and Hydrogen Fuel and Electric Battery Power within Transportation Office – re-integration of Our 17 National Laboratories: Argonne National Lab (ANL), Brookhaven National Lab (BNL), Idaho National Lab (INL), Lawrence Berkley National Lab (LBNL), Lawrence Livermore National Lab (LLNL), Los Alamos National Lab (LANL), Oak Ridge National Lab (ORNL), Pacific Northwest National Lab (PNNL), Sandia National Lab (SNL), The National Renewable Energy Laboratory (NREL) et al.

- Department of Justice

- Acquires FDA and FSIS from Agriculture. Other acquisitions: EPA, Alcohol and Tobacco Tax Bureau, CPSC, OSHA, FERC for health and safety litigation. For Civil Rights, EEOC, NLRB, CRC and the FEC will litigate for the People. Concerning money matters, the FTC, CFTC, FDIC, the FED, SEC, WHD, USD Customs and Border Protection, and the FCC will be litigating for the People (If the FCC has no litigation potential, it can be moved into Communication Department). Establishment of an FBI Peace Officer Team in every 100,000 population Community. Retention of US Marshals.

- Department of the Interior

- Establish Management Teams “on site” at National Parks, Monuments, Preserves, etc. rather than within general communities, with 50 additional Administrative Teams (one in each state) to oversee on-site Management

- Department of Transportation

- Continued funding for FAA.

Tax Reorganization Acts

10% Income Investment Act

10% off the top of total Revenue earned by individuals, businesses, and corporations.

1) Money, clearly documented, that is given to another American Resident,

2) Money collected from businesses for the Temporary Payroll Tax, and

3) Money given to a specific Federal List of ‘Deductible Charities’. Criteria for Legitimacy:

- Does it establish Justice, insure Domestic Tranquility, provide for the Common Defense, promote the General Welfare, or secure the Blessings of Liberty to Ourselves and our Posterity

- Must be approved and listed by the Federal Government on their Charitable Deduction Website

- all submissions would be reviewed to determine their legitimacy

On the list already:

- Federal Research and Development

- U.S. Security Department

- Public (Federal) Education

Healthcare Taxes

- Alcohol

- Tobacco

- Food Additive / Calorie

- Food Poisoning

- Food Allergy

- Beef Allergy

- Antibiotics

- Accident

- Pollution (Air, Soil & Water)

- Birth / Birth Control

1% Land Value Tax

- Land Value locked in at time of legislation, only two-thirds vote in Congress can raise land value

Transportation Taxes

Numbers on this yet to be determined, will be based on the Transportation Bill introduced in a separate session of Congress

FAA Tax

- Extra 10 cents a pound on Air Freight and checked luggage

- One Penny per mile tax on any flight taking off from a US Airport

Water Consumption Tax

- 0.274 cents per gallon

Temporary Payroll Tax

- Act will be established for an Eight-year period only, and completely new legislation must be introduced and approved for this tax to continue in any form.

- Rates

- Employee: 5% off the top of gross earnings

- Employer: Double employee’s contribution (or 10%), to equal 15% of employee’s pay

- Self-employed: 5% off the top of gross earnings + 10% off the top of income tax for a total of 15%

Earth [EPA] Tax

- $20 per person charge, collected within each Community to pay for Environmental Protection Agency

- Provision to deduct delinquent payment from personal Retirement Account on December 31 of each year if amount is not paid by that time.

- Payment required from all citizens eight years of age and older.

Community Tax

- $20 per person charge, collected within each Community to pay Bank Loan for Community Center

- Provision to deduct delinquent payment from personal Retirement Account on December 31 of each year if amount is not paid by that time.

- Payment required from all citizens eight years of age and older.

10% Import Tax

All International trade transactions going through US Ports of Entry will receive this 10% Import Tax, collected by Customs…The tax will be imposed much like a VAT (Value Added Tax), where the Importer will not be charged anything, but Americans will be charged 10 cents for every dollar worth of product they purchase from overseas…Ten cents will go to Us, the Federal Government, and the dollar will go to the importer.

10% Estate, Inheritance, Capital Gains, Gift Tax Mineral Taxes

Any form of Capital Gain will be taxed 10% during that Calendar Year. Especially in Investment and other gambling forms, losses can be used to offset gains within the same year.

Waste Taxes

- Imposed on plastic, paper, bio-medical, Electrical, industrial, chemical, all forms of hazardous waste.

Federal Government Reorganization (Phase 2)

- Federal Business Act (Established Through Department of Labor and Commerce)

Establishes logistics, parameters, and goals of the following businesses:

- Air Traffic Control

- Carbon Capture Business

- Communication Businesses

- Community Center Retail Services

- Construction Businesses

- All things Transportation

- Electric Vehicle Battery Production

- Education Businesses

- Experimental Integrated Steel Business

- Federal Airlines

- Green and Clean Concrete Businesses

- Health Care Business

- Hemp Production & Manufacturing Businesses

- Hydrogen Fuel Production

- Hydrogen Fueling Stations

- Hyper-loop / High Speed Transport Services

- National Parks & Monuments Tourist Business

- Recycling Businesses [Including Recyclable Plastics]

- Recycled (Mini) Steel Businesses

- Regenerative Farming Businesses

- Timber to Lumber Businesses

- Vertical Farming Businesses

- Waste Management Businesses

2. Sustainable Farming / Food Bill

- Establishes 250 acres within designated Communities for Regenerative Farming

- Establishes a large Vertical farm directly within 100,000 population Communities

- Potential for housing farm within the Community Center space if necessary

- Establishes Educational involvement in the farming process for learning and community service purposes

3. Education Bill

- Establishes the method of funding (through personal accounts of citizens)

- Establishes classroom size, use of second counselor / instructor, school businesses, online communication network and database, school year (four 13-week quarters broken into two 5-week tracks with a one and a two-week break) and other logistics

- Establishes new Associate Degree logistics for 11th -12th grades

- Establishes two-year Daycare, Pre-K, Kindergarten (first six years)

- Establishes important curriculum shifts (e.g., the Peace Track, early language acquisition, Democracy and Civic Virtue training, Payback requirements, etc.).

4. Universal Healthcare Bill

- Establishes logistics of providing healthcare within communities of 100,000 people

- Establishes the behavioral and mental heath mandate

5. Prison Rehabilitation Bill

- Establishes right of Government to intervene on a citizens’ behalf, and re-educate, rehabilitate, counsel and treat all criminal offenders

- Offers logistical two-year plan for successful integration of individuals into a meaningful societal role

6. Communication Bill

- Establishes building of Grids, setting rates

- Health Care

- Government

- Education

- Intra-Community (between Federal businesses, for instance, to foster best practices)

7. Clean Energy Bill

Establishes legality of Publicly owned Sustainable Energy Grid, rates, logistics, funding, allocation, etc.

8. Housing Bill [Affordable, Homeless, Off-Grid]

- Establishes right to build in conjunction with goal of creating diversity, affordability, community, equality, and the right to the basic need of secure shelter, etc.

- Connects Public Businesses to this endeavor in order to meet financial goals for affordability

9. Political Campaign Reform Referendums

- Establishes use of Communication Grid to make voting easy and accessible

- Establishes platform for candidates to run their campaign online, and for public to know their candidates and choose between them

- This allows for the main purpose of this bill: to take money out of the equation by offering the voting public equal and free access to the candidates and their issues, and insisting on the exercise of each citizens’ civic duty to choose

ALSO:

Modification of State Property Taxes, State Educational Funding, State Prison Laws

Federal Government Reorganization (Phase 3)

- New Embassy / Global School Bill

- A Law Establishing the building of Global Schools and New Embassies within them

- International Peace Treaty

- A Law Establishing Our conduct in relation to the world; a proactive statement of how We will conduct Ourselves regardless of how the rest of the world acts (guidelines for sticking to Our principles, avoiding any reactive or hasty decisions, and the ability to sanction Ourselves for breaking these guidelines.

- Private Sector Weapons Manufacturing Bill

- A Law Establishing the Selling of Weapon to Other Countries as an Act of Treason

- New FDA Legislation

Transportation Bill

A Bill establishing affordable transportation options that:

- Maximize safety

- Are Carbon free

- Include Micro-mobility, bikes, and foot traffic

- Federalize ridesharing

- Take emergency, delivery, waste management, and heavy shipments off main roads (possibly onto rail systems)

- Establish a high-speed ground choice

Minimum Wage / Maximum Work Week Laws

- 30-hour maximum work week

- $15 per hour Federal Minimum Wage

- $22.50 an hour rate for every hour over 30 that an employee works in a given week.

- If employers wish to avoid these wage or work week hassles, there will be an option to pay employees a yearly salary instead. The new minimum salary will be $31,200 a year in order to waive the 30 hour a week requirement.

Immigration Bill

- Laws establishing path to potential citizenship for non-citizens coming up through the Immigration Centers.

- A four-year program: 2 years of education, and 2 years of service within their home country (or another country if returning home involves personal risk)

- Establishment of benefits to these individuals during this process, and once citizenship has been established

- Chance to enjoy retirement benefits through paying 10% income investment tax

Potentially on the docket:

- Federal Government Reorganization (Phase 4)

- Universal Language Bill [Lakota?]

- New Drug Laws [?]

- New Civil Rights Laws

- Human Property Rights Act