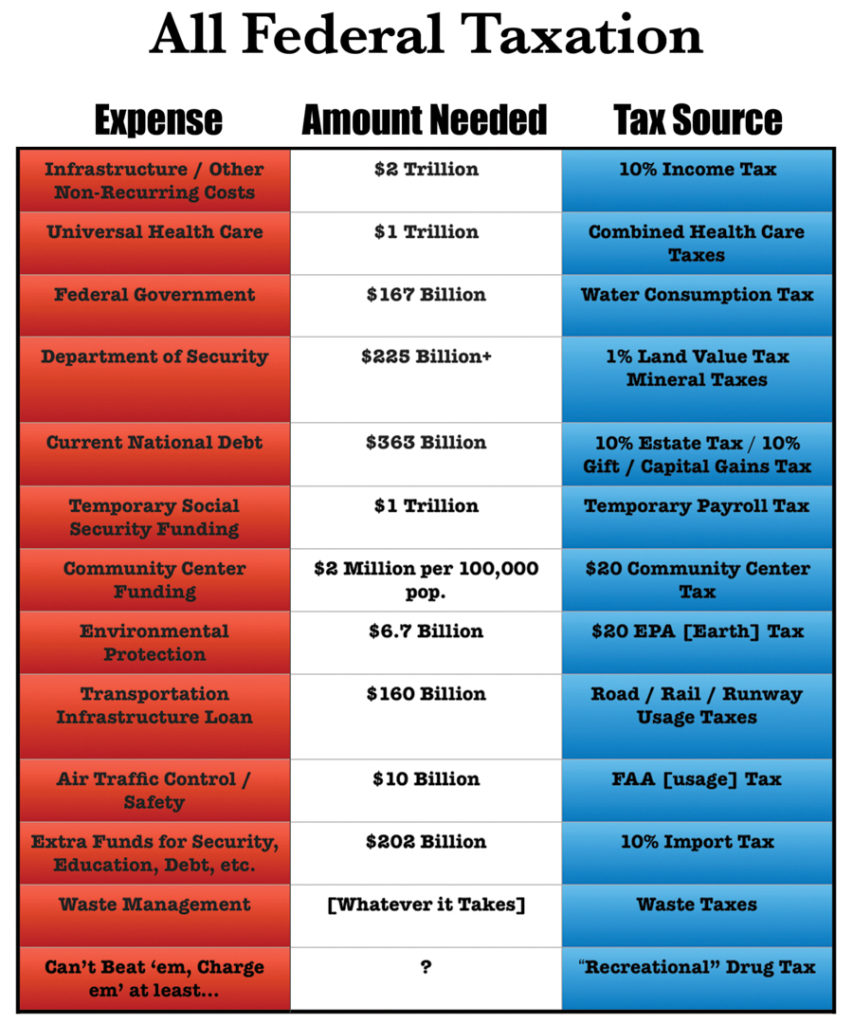

Table of contents

10% Income Investment Tax

This tax would take 10% off the top of all total Revenue earned by individuals, businesses, and corporations. The only allowable deductions would be:

- Money, clearly documented, that is given to another American Resident,

- Money collected from businesses for the Temporary Payroll Tax, and

- Money given to a specific Federal List of ‘Deductible Charities’. Criteria for Legitimacy:

- Does it establish Justice, insure Domestic Tranquility, provide for the Common Defense, promote the General Welfare, or secure the Blessings of Liberty to Ourselves and our Posterity

- Must be approved and listed by the Federal Government on their Charitable Deduction Website

- all submissions would be reviewed to determine their legitimacy

On the list already:

- Federal Research and Development

- U.S. Security Department

- Public (Federal) Education

Health Care Taxes

These taxes would be placed on specific products, services and activities that carry some direct health risks, in order to help pay for The Third Option Universal Healthcare in a fair manner. The list would include:

Alcohol ($0.33 per “Standard Drink” [Alcohol By Volume (ABV) X number of ounces = 60]

Tobacco ($0.50 a cigarette, or $12.50 a pack of 25)

Food Additive

- Saturated Fats – 1 cent per gram in the product

- Sodium – 1 cent for every 400mg in the product

- Sugar – 1 cent for every 4 grams in the product

- Trans Fat – 3 cents for every gram in the product

- Artificial Sugar – multiply mgs by sweetness (200-20,000 X) = “sugar” in grams, then 1 cent for every 4 grams, just like natural sugars

- Artificial Flavors – 1 cent per every serving if artificial flavors are present in the product [secret recipes don’t allow public knowledge – companies must pay for this privilege] NOTE: these chemicals are added to fool us into eating more of it

- “Natural Flavors” – 1 cent per every serving if “natural flavors” is listed on the product [name the flavor in the ingredients and we cannot charge you]

- Artificial Colors – 1 cent per every serving if artificial coloring is present in the product [there are organic / natural colors available – use them instead and avoid the tax] NOTE: these are also used to entice you into eating more

- Preservatives – 1 cent if a chemical / artificial preservative is present in the product, specifically BHT / BHA [we don’t want food poisoning, but there are safe options and if processors “cut corners” there will be a “health” price to pay]

Calorie Taxation (1 cent per 74 cal. consumed or 27 cents per 2000 calorie day = $100 per year )

Food Poisoning

- 4.1 cents per pound on produce

- 3.6 cents per pound on meat and poultry

- 2 cents per egg (caged)

- 1 cent per egg (cage free)

- 4 cents per gallon of pasteurized milk

- 8 cents per gallon of raw milk

- 4 cents per pound of pasteurized cheese

- 8 cents per pound of raw cheese

- 18.9 cents per pound of fish / shellfish

Food Allergy

- 12 cents per gallon of milk

- 14 cents per dozen eggs

- 44 cents per pound of peanuts

- 2.7 cents per gram of soy

- 0.65 cents per pound on wheat

- 5.2 cents per pound of fish

- 6.3 cents per pound of shellfish

- 6 cents per pound of sesameBeef Allergy (12.1 cents per pound)

- Antibiotics (16 cents a pound added onto meat where antibiotics was administered)

Accident

- $105.41 on yearly car registration

- $342.45 on yearly motorcycle registration

- $25 per year per gun, registration

- $5 on all addictive prescription drug copays

- $15 on helicopter license / registration

- $10 on private plane landing fees

- $40 a year bike registration

- $1 on National Park Visitor fee

- $1 insurance charge on Beach Rentals

- $5 renewal fee on Scuba ‘C-Card’

- $5 on yearly registration renewal for all Jet Ski / Personal Watercraft

- $5 on yearly registration renewal for all boats

- $5 on Ski and Snowboard lift tickets

- $20 on annual registration renewal for snowmobiles

- $28 for ATV annual registration fees

- $5 insurance charge on Go Kart races

- $1 insurance charge per participant when registering all sports teams and leagues

Pollution (Air, Soil & Water) ($37 per metric ton of carbon produced)

- Gasoline: 32.9 cents per gallon

- Diesel: 37.6 cents per gallon

- Jet Fuel: 35.4 cents per galloon

- Electricity: 1.7 cents per KwH

- Mercury Emissions tax 2.2 cents per pound on coal

- $32.46 per acre of land use

- 20 cents per pound on beef

- 5 cents per pound on pork

- 4 cents per pound on chicken

- 4.8 cents per pound coal

- 0.5 cents per pound of charcoal

- 1 cent per gallon on kerosene, propane, etc.

- 2 cents per gallon on spray paints, paint removers, degreasers, solvents

- 2.1 cents per pound on meat for water pollution

Birth / Birth Control

- 45 cents tax per 3-month dosage on Birth Control products

- $6,250 charge per birth (baby insurance)

1% Land Value Tax

This special tax is designed to pay for our military, who we basically hire to protect our property. Since all of us live in some form of shelter, this 1% value on property would be assessed on owners, renters, and even on mobile homes; tax amount would be based on square footage. Eventually, land value would completely replace all other ‘property’ tax, because the things property tax typically pays for (schools, infrastructure, etc.) would already be covered elsewhere.

- Land Value would be locked in at time of legislation; only two-thirds vote in Congress can raise the land value

Transportation Taxes

Whichever way we decide to fix this infrastructure, the cost would be around $160 billion a year. We could either charge $721 per registered driver each year, or 5.3 cents per mile of usage. To further disseminate this cost fairly, we could make this a ‘progressive’ tax based on the weight of the vehicle driven (heavier vehicles exponentially damage roads), and do not forget to figure in the extra 33-38 cent charge if the vehicle runs on gasoline or diesel fuel, respectively.

FAA Tax

We need $10 billion to pay for our Air Traffic Controllers, and also need money for our airports and runways. Taxes include:

- Extra 10 cents a pound on Air Freight and checked luggage

- One Penny per mile on any flight taking off from a US Airport

Water Consumption Tax

Federal government management can run on $167 billion a year. We would charge people:

- 0.274 cents per gallon

This would bring in about $100 per person each year, or approximately $33 billion. The big bucks would actually come from the meat and produce industry, who would have to pay $234.8 billion and $35.8 billion in taxes, respectively, to cover their exorbitant water usage. This, would bring in a total of $303.2 billion each year, or $136.2 billion more than we really need, but the hope is that when this cost is transferred to the consumer, through raised prices on meat and produce, either meat consumption would go down, or the meat industry would be forced to figure out a way to be less wasteful.

Temporary Payroll Tax

This tax should only need to be in effect for about 8-10 years after the National Public Bank is established; at that point, Bank dividends should be able to pay people enough to eliminate the need for any kind of payroll tax (universal health care would no longer need this tax, either).

Rates

- Employee: 5% off the top of gross earnings

- Employer: Double employee’s contribution (or 10%), to equal 15% of employee’s pay

- Self-employed: 5% off the top of gross earnings (plus 10% off the top in income tax, for a total of 15%)

Earth [EPA] Tax

This tax would pay for our Environmental Protection Agency, which would now be a slew of environmental lawyers working on commission to hound all polluters big and small. Typical lawyers get 33.3% (sometimes 40%). We would give them 33.3%, then take out 10% of their income (3.3%), so in essence we would pay our lawyers and staff 30% of the take and keep 70% for our Retirement Dividend and / or some Health care Benefits. They would undoubtedly get rich off of this arrangement.

The tax itself would cost:

- $20 per person, collected within each Community.

- Provision to deduct delinquent payment from personal Retirement Account on December 31 of each year if amount is not paid by that time.

- Payment required from all citizens eight years of age and older.

These lawyers would be our environmental watchdogs, and there would be lots to bark at, and bite into:

- Chemical Manufacturing

- Industrial Estates

- Industrial Dumpsites

- ASGM – The artisanal gold mining industry

- Tanneries – process of producing leather from raw animal hides / skins

- Lead Smelting – extraction of pure lead from its ore – toxic wastewater, solid waste, as well as volatile compounds like sulfur dioxide that are released into the air

- Mining and Ore Processing – mined and concentrated prior to use – process results in large volumes of waste that are often loaded with pollutants like mercury, lead, cadmium, etc. – new technologies have curbed waste, but not every mining and ore processing company adopts clean technology [Irresponsible practices]

- ULAB. According to Pure Earth, the industry dealing with ULAB is one of the world’s 10 most polluting industries – Lead-acid automotive batteries

- Dye Industry

- Product Manufacturing

- Agriculture Industry – fertilizers, groundwater contamination, pesticides, manure management, soil management, etc.

- Recycling Management – companies that do not conform to our guidelines (types of packaging, excessive packaging, etc.)

- Industrial Waste, Construction Waste, Hazardous Waste, Bio-Medical Waste

- Ozone Layer Depletion: this is credited to contamination brought about by Bromide and Chlorine found in Chlorofloro carbons (CFC’s).

- Nuclear Issues: Radioactive waste is considered to be harmful for humans, plants, animals and surrounding environment.

- Acid Rain: this corrosive downpour is likely be brought on by the use of fossil fuels, or from anything that discharges sulfur dioxide and nitrogen in the air, such as volcanoes or spoiling vegetation.

- Littering and Landfills: Littering can have a huge financial and environmental impact, while landfills are nothing but huge garbage dumps that make the city look ugly and produce toxic gases, some of which prove fatal for humans and animals.

Community Tax

A Community Center would need to be built for every population of 100,000, in order to house all Federal businesses and services. If everyone in the community chipped in $20 a year, it would pay for the mortgage on a $34 Million structure. At $100 per square foot (the going rate for our Construction business), we could potentially build 340,000 square feet of space. A second plan could be to build a 200,000 square foot facility, then have $800,000 left over to use for various Community services (although the hope is that retail spaces and meeting / event spaces within the Center would bring in enough revenue to pay for the other “free” services offered there).

Each Community could raise this money in its own way, either by direct collection of $20 per person (kids could work to pay their share), or perhaps the retail businesses kept within the Centers might easily cover this tab as well. Either way, the cost is equal to $20 per person X 100,000 population or $2 Million per year on the mortgage payment.

- $20 per person charge, collected within each Community to pay Bank Loan for Community Center

- Provision to deduct delinquent payment from personal Retirement Account on December 31 of each year if amount is not paid by that time.

- Payment required from all citizens eight years of age and older.

10% Import Tax

All International trade transactions going through US Ports of Entry would receive a 10% Import Tax, collected by Customs. This would replace most current duties, taxes and fees.

The tax would be imposed much like a VAT (Value Added Tax), where the Importer would not be charged anything, but Americans would be charged 10 cents for every dollar worth of product they purchase from overseas. Manufacturers and entrepreneurs would undoubtedly pass that cost onto the next consumer of the good. If the good is a “raw material”, it will likely be resold more than once. A $1 item would receive a ten-cent import tax and cost the buyer $1.10. Ten cents would go to us, the Federal Government, and the dollar would go to the importer.

We encourage all countries to do the same to us. If we are to eventually become a Global Community, the various Governments should be receiving some sort of “income tax” from the participation of its citizens in the Global Economy.

This would replace the idea of ‘repatriation’. Any so-called “American” product that is made outside the U.S. would now be considered an “import” when sold here in the US. To earn the “Made in America” label, all raw materials, labor, and manufacturing would need to be done ‘in-house’. Products, or any parts thereof, would receive a 10% VAT as they cross our borders, prior to actually being sold to a US consumer.

.

As all International trade transactions go through US Ports of Entry, US Customs Enforcement would be in charge of collecting this tax. Operating expenses for our US Customs Department could cost as much as $6 Billion and would be paid by the Treasury Department out of what is collected. The rest would go toward where it is needed most. Here is an arbitrary priority list:

- Health Care

- Education

- Security

- National Debt

The top 10 imports into the United States are worth roughly $1.57 Trillion, which at 10% would bring Us $157 Billion in Import Taxes. As a way of comparison:

2016 numbers: total tariffs collected came to $34 billion out of $2.2 trillion in imports. In 2017, imports equaled $2.9 Trillion. (a 10% tax would have yielded $290 Billion in 2017).

Trade Facilitation by Customs and Border Patrol

- CBP processed international trade transactions worth more than $2.3 trillion, while enforcing U.S. trade laws that protect the Nation’s economy and the health and safety of the American public. CBP processed more than 32 million import transactions. Duty collection remains a CBP priority, with approximately $45 billion collected from duties, taxes, and fees in FY 2016. In addition, CBP processed $1.5 trillion worth of U.S. exported goods.

- CBP processed more than 27 million cargo containers through the Nation’s POEs, up 3 percent from last fiscal year. CBP conducted more than 31,500 seizures of goods that violated intellectual property rights, with a total retail value of more than $1 billion.

10% Import Tax

All International trade transactions going through US Ports of Entry will receive a 10% Import Tax, collected by Customs. It will replace most current duties, taxes and fees.

The tax will be imposed much like a VAT (Value Added Tax), where the Importer will not be charged anything, but Americans will be charged 10 cents for every dollar worth of product they purchase from overseas. Manufacturers and entrepreneurs will undoubtedly pass that cost onto the next consumer of the good. If the good is a “raw material”, it will undoubtedly be resold more than once. A $1 item will receive a ten-cent import tax, and cost the buyer $1.10. Ten cents will go to Us, the Federal Government, and the dollar will go to the importer. That simple.

We encourage all countries to do the same to Us. If we are to eventually become a Global Community, the various Governments should be receiving some sort of “income tax” from the participation of its citizens in the Global Economy.

This will replace the idea of “repatriation”, or somehow getting our own citizens to pay their taxes. Any so-called “American” product that is made outside this country is also considered an “import” if it is sold here in the US. To earn the “Made in America” label, all raw materials, labor, and manufacturing would need to be done in Our house. Products, or any parts thereof, will receive a 10% VAT as they cross our borders, prior to actually being sold to a US consumer.

As all International trade transactions go through US Ports of Entry, US Customs Enforcement will be in charge of collecting this tax. Operating expenses for our US Customs Department could cost as much as $6 Billion, and will be paid by the Treasury Department out of what is collected through this tax. The rest will go toward where it is needed most. It is probably best to establish an order of priority for who gets consideration first. Here is an arbitrary list:

- Health Care

- Education

- Security

- National Debt

*Note: If Andrew Yang chooses to work with us, The Third Option promised him this money would go toward his “Freedom Dividend.”

Numbers

The top 10 imports into the United States are worth roughly $1.57 Trillion, which at 10% would bring Us $157 Billion in Import Taxes. As a way of comparison:

2016 numbers: total tariffs collected came to $34 billion out of $2.2 trillion in imports. In 2017, imports equaled $2.9 Trillion. This implies that in 2017, a 10% tax would have yielded $290 Billion.

Trade Facilitation by Customs and Border Patrol

- CBP processed international trade transactions worth more than $2.3 trillion, while enforcing U.S. trade laws that protect the Nation’s economy and the health and safety of the American public. CBP processed more than 32 million import transactions. Duty collection remains a CBP priority, with approximately $45 billion collected from duties, taxes, and fees in FY 2016. In addition, CBP processed $1.5 trillion worth of U.S. exported goods.

- CBP processed more than 27 million cargo containers through the Nation’s POEs, up 3 percent from last fiscal year. CBP conducted more than 31,500 seizures of goods that violated intellectual property rights, with a total retail value of more than $1 billion.

10% Capital Gains (Estate, Inheritance, Gift, Mineral) Taxes

As difficult as it is for 99% of us to comprehend, there are actually people who make money without doing anything. More than any other group, those who make money for nothing should be grateful they reside in the good ole ‘U.S. of A.’ In The Third Option plan, any kind of overall gain throughout a calendar year by any individual would be considered income and subject to a tax equal to 10% of the overall gain. Whether you found the money, stole the money, earned the money, or were simply handed the money, a 10% tax would be due at the end of the year. How you came to acquire the money makes no difference to the rest of us.

While you are alive, spend your money any way you want. The day after you die, whatever you did not take with you is no longer yours. On some other planet, there is undoubtedly a society that would take everything back, in order to redistribute it to the living. Here, we would only take 10%, and to be fair, once the debts are paid on someone’s “estate”, everyone would be subject to this 10% Estate Tax. If you have $10 in your pocket when you die, the rest of us would get $1 of it.

Proposal:

10% off the top for all “includable property” (cash, securities, trusts, real property, and other assets) minus reasonable deductions (mortgages, debts, funeral expenses, estate administration, or contributions to charities on the Federal Government’s short list – sorry, but property transferred to a surviving spouse might still incur this tax). The ‘exemption’ amount (currently $5.49 million $11.7 million $12.06 million) would be eliminated, meaning that if you have $100 in capital left in your “estate” at the time of your passing (meaning ‘assets’ minus ‘liabilities’), the rest of us get $10 of it.

Statistics:

There are 824 deaths per 100,000 U.S. standard population each year

If We calculate the Estate Tax of 10 estates from $1 million to $10 million ($1M, $2M, $3M…$10M):

- Our Way would collect $5.5 million from these 10 estates

- The 2017 way of doing this would collect $4.8 Million (only would collect on the $6 Million through $10 Million Estates, but these would incur a 40% tax)

- The 2018 way of doing this would collect a big fat $0 (Exemption has been raised to over $11 Million)

Some of the Old Rules:

Secured Debt

- If the deceased died with a mortgage on her home, whoever winds up with the house is responsible for the debt. If the house was owned jointly, the survivor is still on the hook for the mortgage. That’s because the house is security for the debt. If the debt isn’t paid, the bank will take the house and sell it to satisfy the mortgage.

Unsecured Debt

- Any unsecured debt, such as a credit card, must be paid only if there are enough assets in the estate. Unless there was a co-signer, no one else must pay anything on a credit card. Some collection agencies would like the heirs to believe they are liable to pay from their own money, but that’s only possible if they inherit something from the estate before the debts are paid.

Student Loans

- Normally, student loans must always to be repaid. However, student loans will be forgiven upon the death of the borrower, or in certain cases, the borrower’s parents. Proof of death has to be provided to either the school (Federal Perkins loan) or the lender (FEEL or Direct Stafford Loan).

Taxes

- Not only do taxes not disappear upon death, they could increase. Income taxes must be paid on the deceased’s last return. The estate must pay taxes on any income earned after death, and the heirs may have to pay income tax on any income they may have inherited. The estate’s assets may also be subject to an estate tax on their value, which is separate from the income tax. This is a very complex area, and you shouldn’t face it without the advice of an accountant or attorney.

Gift

- Whether a ‘gift’ is cash, a stock option, or real estate that has already incurred a tax by the previous owner, taxes are all about the individual; this means that from ‘your point of view’, if you have a gain, you need to pay 10% of that gain to the rest of us. This would no longer be considered “double dipping”; if I take my previously taxed money and go buy a coffee with it, the barista could not claim the government is ‘double dipping’ and pocket all the money, either.

NOTE TO PARENTS AND IMMEDIATE FAMILY: stop teaching your children that there is any such thing as money for nothing—those days are soon to be gone. The definition of value is changing; idleness, begging, and hoarding may no longer be considered transferable skills.

Capital Gain

- You must pay a 10% Capital Gain Tax at the time of contract execution on a Prepaid Variable Forward Contracts (PFV)

Definition of a Variable Forward Contracts (PFV)

- Shareholder with a concentrated stock holding promises to sell the stocks to someone down the road in exchange for a bunch of money today (Monster Worldwide, Inc. CEO got 88% of the value of stock he held)

- All Wall Street transactions are now considered “Gambling”, and will be taxed as such. If you win $100 then lose $100 in the same year, you have a net of $0, with no tax that year. If you win $100, but you lose $200, you still have a net of $0, with no tax that year, but you DO NOT get to deduct the other $100 loss the next year. Losses are only taken in the year they happen (they are not carried forward), and losses can never exceed winnings in a given year. (Gamble away, boys).

- Unrealized Capital Gains on Real Estate would receive a 10% Capital Gains tax at the time of the owner’s Death.

- If you keep re-investing your money in more and more expensive “Primary Residences”, there will be no Capital Gains assessed.

- Prior to Death, if any cash is taken out, it would receive a 10% Capital Gain.

- If ownership is transferred to anyone AT ANY TIME, the 10% Capital Gain would be assessed.

BOTTOM LINE: Keep your accumulated wealth to yourself, and we would not take any of it. Share it, and it would become a Gain for whoever is the recipient. When you die, there would be a final accounting, and 90% of what is left can go to survivors of your choosing.

Waste Taxes

Waste is the perfect metaphor to describe Capitalism. Someday, school kids will pile into a boat and go out ‘Waste Watching’. They will spy a floating remnant of Capitalism, a plastic bottle, and the teacher will comment on its historic significance in our evolutionary ‘brush’ with extinction. This, of course, would be a ‘best-case scenario.’

In our current profit-seeking paradigm, science has been kidnapped and forced into prostitution. From nuclear bombs to artificially constructed food products, ‘better living through science’ is coming to kill us all. Scientific Ethics should not be an oxymoron—The Third Option would certainly insist upon scientists adopting a code of ethics going forward—but to be fair to scientists, the problems we have created are all byproducts of poor leadership. In a future where Democracy is actually a ‘thing’, each person would become the leader of themselves, and no one could ever again hide behind the convenient notion that they were ‘only doing their job’.

Our children, in a Third Option Educational model, would become leaders tasked to introduce a new Infinitely Recyclable Plastic Business, a Biodegradable Packaging Business, and new Packaging and Waste Management Strategies. To fund these new businesses, money would be collected from various Waste Taxes.

Proposal:

1) Tax current plastic usage (each year Americans use 50 billion plastic water bottles, 100 billion plastic bags, and 183 billion straws. but we only recycle about 23% of it):

- 10 cents per plastic bag ($10 Billion could be collected).

- 10 cents per plastic water bottle ($5 Billion could be collected).

- 10 cents for every straw ($15 Billion could be collected).

- 10 cents for every Paper Bag.

- 10 cents for coffee or other drink cups.

- 10 cents for any other ‘single use’ item that we decide can or should be taxed (pizza boxes, fast food containers, grocery store cans, bottles, wrappers).

2) Our young children would be assigned to clean up the world we have left for them. Every child would have a yearly responsibility to pay an EPA Tax ($20) and a Community Tax ($20). Although parents could help in collecting trash with their child, the only way a child could pay their $40 tax is through collecting 800 plastic items from the neighborhood (5 cents per item X 800 items = $40). While the money collected through the Plastic Tax would be non-refundable, it would be donated in each child’s name for the work they performed collecting this waste.

3) We would dispose of this trash in the most eco-friendly way possible (and that would NOT be a landfill).

4) We would build new Waste Management Infrastructure.

- OmniProcessors handle all human and animal waste (your cat, your dog, your baby – it all would go in the same hole).

- We would have a Public Waste System based on the following tenets:

- There would be a finite number of Reusable / Recyclable containers (for food, shipping, drinks, etc.)

- Either by returning containers directly where you shop (grocery store, coffee house, Amazon), or by scanning your ID and dropping containers into your neighborhood kiosk, you would be credited for the use of your next container[s]

- Your first containers will cost $10 or more. As long as you returned it, you would be credited for the next one you used; fail to have a credit in your account when you shop again, ouch! Another $10 charge would be assessed.

- All these containers would be infinitely recyclable, so when they get beat up too much, they get melted down and re-made.

- If our New Transportation comes through, we would have driverless Uber technology come to your home for larger items like furniture, etc. Load it in a Van and away it goes.

- Our new Affordable Housing would be designed for easy pick up of household trash by driverless systems.

- Our new Affordable Food outlets would also only use containers that could be reused and returned.

- Our children would be in the biodegradable packaging business, plus melt down and 3D print new infinitely recyclable plastic containers as well.

There is so many ways to create trash, a strategy would need to be created for each category, but the idea is to limit the number of categories and materials used. If there still needed to be a weekly collection necessary, per our New Transportation Infrastructure, hopefully we could make it high-tech, cost effective, and user-friendly.

WASTE MANAGEMENT STRATEGY

Human Waste, Food Waste, Animal Waste (pets).

- Food Waste is typically 30% of household trash. Every Community is getting an Omni-processor capable of converting 100,000 people’s organic waste (poop and food) into some electricity, water (for Community to use in whatever way they wish), and fertilizer for their local farming.

Plastic

- Going to eliminate all except infinitely recyclable plastic, in order to make the amount of plastic finite

Paper (mail, packaging)

- Let’s eliminate paper someday! Until then, if it doesn’t touch food, it can be recycled

- No more paper touching food – biodegradable packaging made out of mushrooms or really whatever can just be thrown into the Omni-processor right along with the food. If we must burn it, we need carbon capture tech on it!

Stubborn trash

- like meat packaging, Ziploc bags, paper towels, tea bags, peanut butter jars, toothpaste tubes and plastic lined paper cups will need to be addressed as well – no item gets a “free pass”.

BOTTOM LINE:

We must lead by example

- Our food outlets would all use our new containers; customers would use them, bring them back, and we would recycle them.

- Our shipping business would use our new containers; we would incentivize Our customers to return them, and we would reuse them over and over.

- Within our Affordable Housing, we would build our tenants an easy way to dispose of food waste, plus an easy way to return (and receive credit for) various reusable packaging

- Uber-like businesses would pick up recycling for a price (for the lazy), especially big stuff like furniture, etc.

Our Own Coffee Cup Business

- Buy one cup from the coffee shop, and your account would register your purchase.

- get “credit” when you bring it back – your next cup is only the usual 10 cents (factored in to store’s price, but paid to us).

- get credit for bringing someone else’s cup back if you find one (maybe get 10 cents off for each return over any purchased)

- get 10 cents off for bringing your own mug

NOTES:

- Americans waste a lot of food — about 133 billion pounds a year, or roughly one-third of all the food produced in the U.S. In addition to squandering money and throwing away a precious resource, all that waste creates an enormous environmental problem. Food waste often winds up in landfills, where it rots and releases large quantities of methane, a potent greenhouse gas that contributes to global warming.

- You cannot recycle Pyrex, or glass of different colors – if we use it, we cannot color it, and let’s not put a sticky label on it!

- Coffee cups – 600 billion a year, 6 billion or 1% of them are Starbucks – also Dunkin’ Donuts and McDonalds. Thin plastic lining inside paper shell makes them unprofitable to recycle for anyone, so end up in landfills or in oceans; it is tough to house the hot liquid without lining (Some company brought out compostable cup, but this too needs a special place to go for composting, it cannot be done at home).

- Best solution – bring your own mug – perhaps Starbucks can supply you with a mug from their shelf, but only once – they do already give you 10 cents off if you bring your own mug

- Recyclers get only 20% return on investment of recycling our waste

- Glass is essentially worthless now (competes with sand?), many places won’t even take it

- Plastic shopping bags are recyclable at the store, but not from households

- By using hot water to thoroughly clean the plastic, it wastes more money than it saves

- Multi-layered packaging (chip bags), pizza boxes (food touching paper), over-packaging (shipments), toothpaste, small yogurt cups – all problematic

- Currently, state certified recycling centers pay a minimum of $1.60 CRV for aluminum cans; $1.28 CRV for clear PET plastic bottles; $0.58 CRV for HDPE plastic bottles (similar to the large water jugs); and $0.10 CRV for glass bottles.

- 32-55 aluminum cans make a pound, or 5 cents a can

- 16-32 plastic bottles per pound or 4-8 cents a bottle

- Syringes are supposed to be taken back to pharmacies, but wind up in bins

- Plastics can leach harmful chemicals like BPA, BPS, phthalates, xenoestrogens, lead and antimony into food, beverages and the environment.

- These toxic chemicals—found in most of the plastic, PVC and vinyl items produced today—have been linked to obesity, enlarged male breasts, earlier puberty in girls, and increased incidence of breast, prostate and other cancers. In fact, they are so toxic, many plastic additives have been banned in Europe, Canada, China, and an increasing number of cities and states in the U.S.

Most of us know by now to avoid toxic, BPA-ridden plastic beverage bottles, plastic food storage-ware, plastic wrap and resealable (or zipper-lock) food storage bags. (If you didn’t know that, now you do!)

Still, plastic is everywhere, so toxins can be found in the places you might not know about, like:

- BPA-free plastic bottles (BPS),

- the inside lining of nearly all canned food, soda and baby formulas (BPA/BPS),

- canning jar lids (BPA),

- toothbrushes and toothpaste tubes (BPA),

- plastic lunchboxes and toys (phthalates and lead),

- dental sealants and composite fillings (BPA/BPS),

- plastic and vinyl jewelry, purses, shoes and other fashion items (phthalates, mercury and lead),

- cash register receipts (BPA/BPS), and more.

#1 – PET or PETE (polyethylene terephthalate)

- PET is used for water and soft drink bottles, mouthwash bottles, containers for condiments like nut butters and ketchup, and TV dinner trays. PET is considered safe, but it can actually leach the toxic metal antimony, which is used during its manufacture.

- One study that looked at 63 brands of bottled water produced in Europe and Canada found concentrations of antimony that were more than 100 times the typical level found in clean groundwater (2 parts per trillion).

- The study also found that the longer a PET bottle sits on the shelf—in a grocery store or your pantry—the greater the amount of antimony present. It is also thought that the amount of antimony leaching from these PET bottles increases the more they are exposed to sunlight, higher temperatures, and varying pH levels.

- Brominated compounds have also been found to leach into PET bottles. Bromine displaces iodine in the body and is a central nervous system depressant. It can accumulate over time, and trigger paranoia and other psychotic symptoms. Avoid if you can.

#2 – HDPE (high-density polyethylene)

- HDPE is used in butter tubs, milk jugs, juice, household cleaner and shampoo bottles, as well as cereal box liners and grocery bags. It is often considered a low-toxin plastic, but like almost all plastics, it has been found to release estrogenic chemicals.

- In one study, 95 percent of all plastic products tested were positive for estrogenic activity. This means they can disrupt your hormones and even alter the development of your cells, which puts infants and children at even greater risk. In this particular study, even HDPE products that were free of bisphenol-A (BPA) still tested positive for other estrogenic chemicals. Use with caution.

#3 – PVC (polyvinyl chloride)

- PVC is used in plastic cooking oil bottles, deli and meat wrappers, shrink wrap, sandwich baggies, and plastic “saran” wrap. It is also found in plastic toys, lunch boxes, tablecloths and blister packs used to hold medications. And it is commonly used to make jewelry and faux-leather purses, shoes and jackets.

- PVC contains numerous toxic chemicals including lead and DEHP, a type of phthalate used as a plastics softener. As if the lead weren’t bad enough, phthalates are considered “gender-bending” chemicals which cause the males of many species to become more female. These chemicals disrupt the endocrine systems of wildlife, causing testicular cancer, genital deformations, low sperm counts and infertility in a number of species, including polar bears, deer, whales, otters, and frogs, among others.

- Scientists believe phthalates cause similar harmful effects in humans. If your home has flexible vinyl flooring, or those padded play-mat floors for kids (often used in day cares and kindergartens, too), there’s a good chance it is made from toxic PVC. PVC flooring has also been linked to chronic diseases like allergies, asthma and autism.

- PVC is one of the worst health and environmental offenders. Avoid at all costs.

#4 – LDPE (low-density polyethylene)

- LDPE is considered to be low-toxin plastic and it is used in bread bags, produce bags, squeezable bottles as well as coated paper milk cartons and hot/cold beverage cups. While LDPE does not contain BPA, it can leach estrogenic chemicals, much like HDPE. Use with caution.

#5 – PP (polypropylene)

- Polypropylene is used in straws, yogurt containers, and syrup, ketchup, and medicine bottles. While polypropylene is considered a low-toxin plastic that is tolerant of heat, at least one study found that polypropylene plasticware used for laboratory studies did leach at least two chemicals. Use with caution.

#6 – PS (polystyrene)

- Polystyrene is also known colloquially as “Styrofoam,” and is used in egg cartons, disposable plates, cups and bowls, take-out containers, coffee cups, meat trays, packing materials, and more. When heated, polystyrene can release styrene, a suspected nerve toxin and carcinogen.

- Heating Styrofoam or using it for hot foods and beverages makes it leach toxins even more, so try to avoid food and drinks in polystyrene containers at all costs, and definitely don’t use them in the microwave! Avoid at all costs.

#7 – Other

- #7 is a catch-all designation used to describe products made from other plastic resins not described above, or those made from a combination of plastics. While there are many different types of #7 plastics, the most common include 5-gallon-size water bottles, baby bottles and other polycarbonate plastics.

- It’s difficult to know for sure what types of toxins may be in #7 plastics since they vary so much, but there’s a very good chance that if they are polycarbonates, they contain bisphenol-A (BPA), or the equally concerning chemical created to replace BPA, known as Bisphenol-S (BPS).

- BPA and BPS are both endocrine disrupters that interfere with your body’s hormones, affecting your mood, growth and development, tissue function, metabolism, sexual function and ability to reproduce. Over 6 billion pounds of BPA are produced each year, so it is no wonder that the CDC found that 93% of Americans over the age of 6 have BPA in their urine and bloodstream!

- Some of the greatest concern surrounds in-utero exposure to BPA and BPS, which can lead to chromosomal errors, spontaneous miscarriages and genetic damage. But evidence is also very strong that these chemicals are harming adults and children, too, causing decreased sperm quality, early puberty, stimulation of mammary gland development, disrupted reproductive cycles and ovarian dysfunction, cancer, and heart disease.

- Research has found that “higher BPA exposure is associated with general and central obesity in the general adult population of the United States.” Another study found that BPA is associated not only with obesity, but also with insulin resistance, which is an underlying factor in many chronic diseases. Avoid at all costs.

WASTE

- Liquid or Solid Household Waste – This can be called ‘municipal waste’ or ‘black bag waste’ and is the type of general household rubbish we all have.

- Municipal Solid Waste (MSW)

- Liquid waste is also commonly found both in industries

- Solid rubbish can also be found in commercial and industrial locations

- Hazardous Waste (households) – Solvent-based paints, Pesticides and other garden chemicals, Batteries (for example car, mobile phone or regular household batteries), Motor oils (for example from cars or mowers), Petrol and kerosene, Cleaning and polishing chemicals, Swimming pool or spa bath chemicals, Pharmaceuticals (all medicines), Obsolete computer equipment, Thermometers, barometers, thermostats, fluorescent tubes and compact fluorescent globes (CFLs).

- Bio-Medical/Clinical Waste –Four major types:

- General Medical Waste

- Infectious Medical Waste

- Hazardous Medical Waste

- Radioactive Medical Waste

- Electrical Waste (E-Waste) – TVs, computer monitors, printers, scanners, keyboards, mice, cables, circuit boards, lamps, clocks, flashlight, calculators, phones, answering machines, digital/video cameras, radios, VCRs, DVD players, MP3 and CD players,

- Recyclable Waste Construction & Demolition Debris – concrete, bricks, wood and lumber, roofing, drywall, landscape, even roadways (Green / Recyclable Waste)

- Organic Waste is another common household waste

- Industrial Wastes – any material that is rendered useless during a manufacturing process such as that of factories, industries, mills, and mining operations

- Chemical Waste – Chemical waste is typically generated by factories, processing centers, warehouses, and plants. …

- Solid Waste – includes a variety of materials, including paper, cardboard, plastics, packaging materials, wood, and scrap metal

- Toxic and Hazardous Waste.

Effluent Treatment Plant (ETP) is most cost Effective & technically proven system to remove the unwanted, hazardous chemicals from the wastewater to meets the statutory pollution control requirements, especially for chemicals, pharmaceuticals, phosphating and electroplating wastewaters.

- The World’s Most Polluting Industries – WorldAtlas.com

- https://www.worldatlas.com/articles/the-top-10-polluting-industries-in-the-world.html

Agricultural Wastes

manure and other wastes from farms, poultry houses and slaughterhouses; harvest waste; fertilizer run- off from fields; pesticides that enter into water, air or soils; and salt and silt drained from fields bedding and litter, wasted feed and wastewater from buildings. nitrates commonly associated with fertilizers and agricultural waste runoff, heavy metals in Fertilizers (e.g. lead, cadmium, arsenic, mercury)

TAKEAWAYS

- Low-density polyethylene (LDPE)[grocery bags, produce bags and Ziploc bags] is not usable to recyclers.

- BioCellection – Jeanny Yao and Miranda Wang, the entrepreneurs behind the two-year-old San Jose, California startup – using genetic engineering to create a process that turns LDPE into chemical compounds for use in emulsifiers or cleansers in cosmetics to textile manufacturing. Uses a chemical treatment to break down the LDPE into small carbon-based molecules, then into powder form.

- Cadel Deinking, which spun out of Spain’s University of Alicante three years ago, has developed a process that removes the ink by soaking the plastic in a solvent-free chemical bath (only works on some things) [Polystyrene[ Styrofoam cups, packing peanuts and rigid red picnic cups]

- Agylix’s (Portland) technology breaks the polymer down to molecules, which it sells in liquid form to refiners that will bind the molecules to form polystyrene, according to CEO Ross Patten. Agylix’s technology can go further and convert polystyrene back to crude oil. It did that until last year, when low oil prices made it unfeasible to continue. Polystyrene could cause cancer, soon to be banned.

- Mixed-material packaging [Capri Sun drink pouches or cardboard boxes for soup in the grocery aisle] tightly laminated layers of plastic, cardboard and aluminum foil Saperatec – will separate it all, but doesn’t use the paper.

- Plastics make products lighter, cheaper, easier to assemble and more disposable. They also generate waste, both at the start of their life cycles – the petrochemicals industry is a major source of pollution and greenhouse gas emissions – and after disposal.

- The biggest domestic use by far for plastic resin is packaging (34 percent in 2017), followed by consumer and institutional goods (20 percent) and construction (17 percent). Many products’ useful lives can be measured in minutes. Others, especially engineered and industrial plastics, have a longer life – up to 35 years for building and construction products.

- After disposal, plastic products take anywhere from five to 600 years to break down. Many degrade into micro-plastic fragments that effectively last forever. Rather like J.R.R. Tolkien’s One Ring, plastics can be permanently destroyed only through incineration at extremely high temperatures.

- Innovated by Dr. A. Vasudevan, a chemist from Thiagarajar College of Engineering (TCE), Madurai, the plastic-bitumen road-laying technique is a patented idea. Dr. Vasudevan does not intend to profit from it. Rather, he is making it available to municipalities to tackle the mounting waste plastic piles. The intent is good, and the technology is simple and is described in a dedicated TCE website. It involves:

- collecting waste plastics, including plastic carry bags, cups, soft and hard foams and laminated plastics.

- cleaning it by washing.

- shredding it to a uniform size.

- melting the waste plastics at 165 degrees Celsius at temperatures of 166 degree Celsius and blending it with hot aggregates and bitumen and using this mixture to lay the road.

- Other attempts to improve the environmental credentials of roads include solar road surfaces – one such road is being tested in the village of Tourourvre-au-Perche, Normandy, which cost €5 million (£4.2 million) to build in 2016. However, MacRebur is the first company to use waste plastics in roads.

- Dr Karl Williams, director of the University of Central Lancashire’s Centre for Waste and Resource Management, told Sky News that it remains unclear how environmentally friendly the roads really are: “They are only going on trial roads at the moment, and in terms of what plastics they are using, where the plastic comes from and the level of contamination, there are lots of issues that are still big question marks.”

- How to burn plastic to create energy: The waste combustor processes non-recyclable plastic within two tanks. The top tank converts the plastic to gas through pyrolysis. The gas then travels to a lower tank, where it is burned to generate heat and steam. The steam powers a turbine to produce electricity.

[but we need to capture all the toxins (nitrogen oxides, sulfur dioxide, volatile organic chemicals (VOCs), and polycyclic organic matter (POMs – a solid residue leftover). Burning plastic also releases heavy metals and toxic che